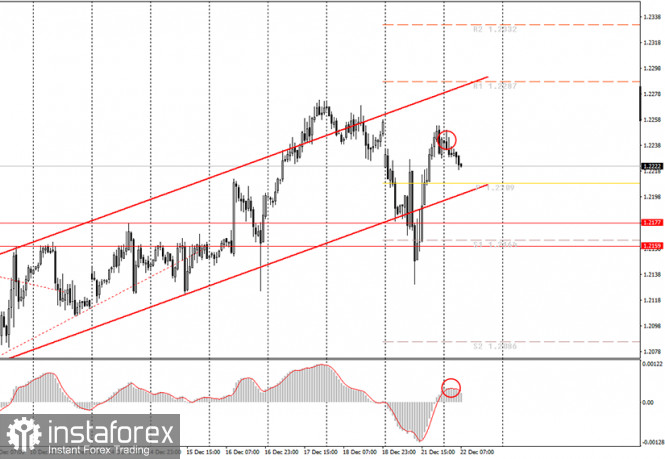

Hourly chart of the EUR/USD pair

The EUR/USD pair made an attempt to bring back the downward movement last night. Take note that the euro's quotes collapsed on Monday, but it did not last long, and it eventually grew on the same day. In fact, the price simply went down 100 points, and then up by the same amount. Despite this, the upward trend was broken as the quotes were leaving the rising channel. Consequently, we expect the euro to fall. Logically, now the price can rush to the previous local low near the 1.2130 level, especially since the pair was already falling to it and also rebounded a couple of days ago. If so, then the potential for the pair's decline is around 90 points from current positions. Yesterday evening we advised you to wait for a new sell signal from the MACD indicator. It was formed that night (circled in the chart). It has a sufficiently strong status, since the indicator has managed to discharge itself properly. Therefore, novice traders could enter the market at the rate of 1.2130 and already be in profit at the moment. You are advised to maintain open sell orders today.

The US will release its third quarter GDP today. However, as we mentioned yesterday, this indicator is already well known to traders, since this is its third estimate. With a high degree of probability, GDP will grow by 33.1% in the third quarter. Market participants should be more interested in the fourth quarter and its performance. Take note that there was a new lockdown in the European Union in the fourth quarter, but the US did not implement one. Therefore, the American economy should do without losses during this period of time, and the European one should not. Therefore, the euro may soon come under market pressure if this factor is taken into account. Moreover, this is an important factor. In addition, the index of consumer confidence in the United States will also be released today, but traders are likely to ignore all of the macroeconomic reports today. With great excitement, the markets will be waiting for news on the new strain of coronavirus.

Possible scenarios for December 22:

1) Long positions are currently irrelevant, since the quotes were leaving the rising channel. Thus, we would not recommend opening new long positions right now, no matter how attractive they may seem. Instead, you need to wait for a new upward trend in order to consider long deals.

2) Trading down looks more appropriate. The MACD indicator formed a rather strong buy signal that night, which we advise you to work out today. Targets - support levels 1.2164 and 1.2086. The second target is located very far away, so we are unlikely to reach it today. It is quite possible that the pair will fall by a total of 50-90 points. If not, then an upward reversal of the MACD indicator will signal the loss of bears' interest in trading the pair. In this case, we would recommend waiting for a new sell signal.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com