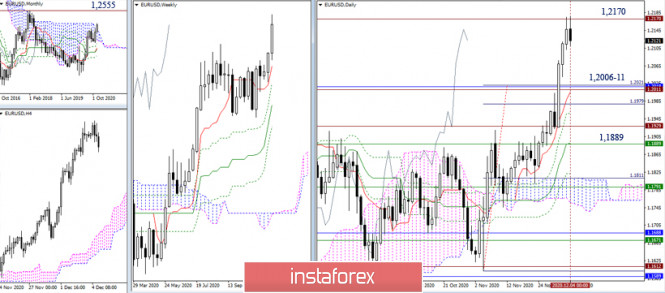

EUR/USD

Bulls continued to rally in the first week of December as it took advantage of the previous month's potential. On Friday, there was a slowdown when testing the historical milestone marked earlier at 1.2170. In case the rebound is confirmed and a downward correction appears, short-term trends will be the main reference points for the decline, first the daily Tenkan, currently located at 1.2006 and combining its efforts with the border of the monthly cloud (1.2019), then the weekly Tenkan, the level is at 1.1889 and strengthens the daily medium-term trend (1.1888). Maintaining positions and consolidating on what has been achieved, and subsequently overcoming 1.2170, will allow traders to consider the following upward benchmarks. In this case, the immediate task will be to update the monthly high (1.2555).

Indicator analysis has no divergences now. The preconditions for the emergence of divergences have not yet been formed. At the same time, take note that Stochastic and CCI are currently in the oversold area on the daily and weekly timeframes. On the daily timeframe, they reacted to the deceleration and marked peaks, preparing to support the bearish sentiment.

GBP/USD

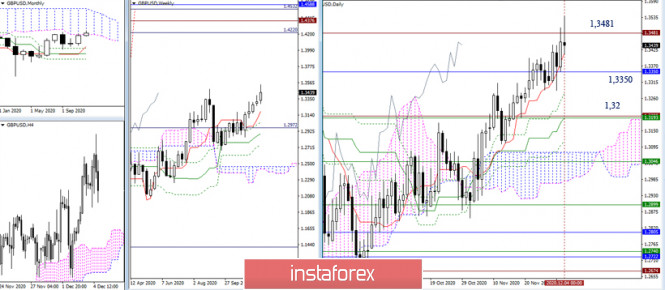

All week the bulls acted with varying success, nevertheless, they managed, unlike their opponents, to consolidate their result on the chart - the pair grew, and the 1.3481 high was tested. The next big cluster of resistance is at 1.44-45-46. Here, the upper border of the monthly cloud (1.4588), reaching the weekly target for breaking the cloud (1.4220-1.4532) and the high (1.4376) is a combination of their efforts. Overcoming these boundaries will be a very significant stage for traders' further prospects for an increase. But inability to cope with the 1.3481 resistance that they may encounter in the near future, thanks to which it is possible to restore the monthly and weekly upward trend, will deprive players of plans to rise to 1.44-45-46. The most significant nearest support is now at 1.3413 (daily Tenkan) - 1.3350 (lower border of the monthly cloud). Consolidating below it will serve as a change in the balance of power in favor of the bears, as a result, we can expect bearish sentiment to strengthen further. The reference point will be the 1.32 area (record level + weekly Tenkan + daily Kijun).

Indicator analysis shows that most indicators retain the prerequisites for forming a divergence. The discrepancies are still valid and growing. The opportunities for the players to rise remain in doubt.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com