To open long positions on EUR/USD, you need:

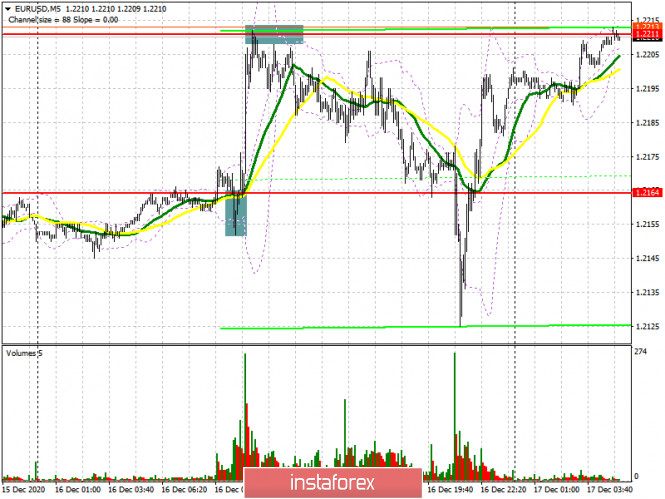

Wednesday was on the side of the buyers, and the Federal Reserve's decision did not make it possible for the dollar to accumulate in order to somehow influence the upward trend of risky assets. Let's take a look at the 5-minute chart and figure out where you can and should enter the market. In my morning forecast, I paid attention to long deals above 1.2164, which is what happened. A breakout and being able to test this range from top to bottom produced a signal to open long positions, its goal was to reach a high of 1.2211, where the bulls actually pulled the pair. The euro sharply grew after we received good data on the services sector in the euro area, also amid speculative sellers removing several stop orders, who were found above the 1.2164 level. Several unsuccessful attempts to surpass 1.2211 led to forming a false breakout and a downward correction to the 1.2164 area. We managed to surpass this level after the Fed announced its decision on interest rates, but we did not get a convenient entry point into short positions.

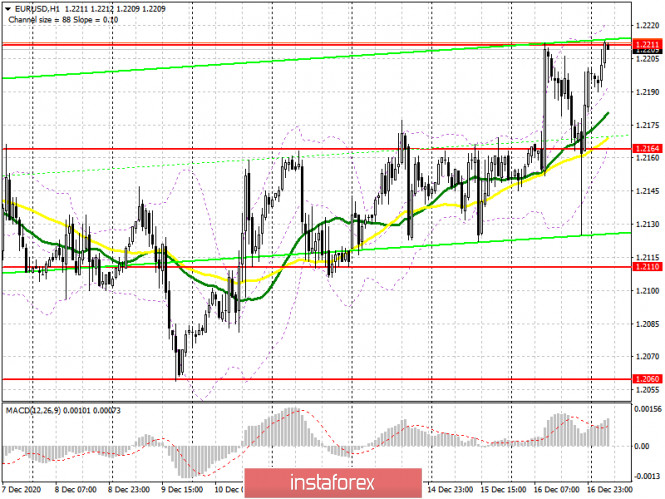

Despite the high volatility of EUR/USD, the pair returned to the 1.2211 area in today's Asian session, where trading is currently underway. In the first half of the day, the entire focus will shift to data on eurozone inflation, which may strengthen the euro, if it turns out to be better than economists' forecasts. Buyers need to surpass the 1.2211 level. Testing it from top to bottom will open a direct road to a new high of 1.2255, with the prospect of updating 1.2297, where I recommend taking profits. The 1.2339 area will be the target at the end of the week. In case the bulls are not active in the 1.2211 area and EUR/USD is under pressure after this data is released, it is best to postpone long deals until support has been updated at 1.2164. Forming a false breakout there will result in producing another signal to open long positions. If buyers fail to protect this area, you can only open long positions in EUR/USD on a rebound after the 1.2110 low has been tested, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Pound sellers are currently focused on protecting the 1.2211 level, where the upward movement stalled yesterday. Forming a false breakout there in the first half of the day, along with weak eurozone inflation in November, produces a signal to open short positions, the main goal of which is to return EUR/USD to the 1.2164 level. There will be a very big battle for this area, just like yesterday. Being able to settle in this area and testing it from the bottom up will lead to a larger sell-off, to a low of 1.2110 which is where I recommend taking profits. In case of a breakout and EUR/USD settles above 1.2211 in the afternoon, it is best to postpone new short positions until a larger resistance at 1.2255 has been tested. I recommend selling EUR/USD immediately on a rebound from the high of 1.2297, or even higher, from the 1.2339 area, counting on a downward correction of 15-20 points within the day.

The Commitment of Traders (COT) report for December 8 recorded an increase in long positions and a reduction in short positions. Buyers of risky assets believe in sustaining the bull market and the euro's growth after surpassing the psychological mark in the area of the 20th figure. Thus, long non-commercial positions rose from 207,302 to 222,521, while short non-commercial positions fell from 67,407 to 66,092. The total non-commercial net position rose from 139,894 to 156,429 a week earlier. It is worth paying attention to the growth of the delta, observed for the third consecutive week, which completely negates the bearish trend observed at the beginning of this fall. We can only speak of a larger recovery after European leaders negotiate a new trade agreement with Britain.

Indicator signals:

Moving averages

Trading is carried out slightly above 30 and 50 moving averages, which indicates buyers' attempt to sustain the upward trend in the euro.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.2211 area will lead to a new upward movement for the euro. A breakout of the lower border of the indicator in the 1.2164 area will increase pressure on the pair and cause the euro to fall.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.