4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 64.3453

The European currency paired with the US dollar continues to trade quite calmly. Today, on Monday, when the markets were shocked by the news of a new strain of "coronavirus" that is spreading very quickly and is more contagious than the "coronavirus" that everyone is already used to, of course, volatility was higher than usual. However, it cannot be said that the euro/dollar pair directly overreacted to the news. By and large, it did not even manage to gain a foothold below the moving average line. Moreover, by the end of the day, the pair recovered almost all the losses that it had suffered in the morning and at night. Thus, by the end of the first trading day of the week, it was already possible to conclude that nothing terrible and extraordinary had happened and the markets very quickly came to their senses. The technical picture, therefore, remains unchanged. The upward trend persists. It still has the status of a fairly strong trend. It is still very difficult to find reasons why traders continue to buy the euro and ignore the dollar. The fundamental background still has a very indirect effect on the movement of the pair. On Monday, everything was classic: strong news arrived and the markets worked it out. Usually, in 2020 (if we take into account the months starting from March when the pandemic began), the "foundation" was simply ignored, and macroeconomic statistics were not taken into account. Thus, the upward trend is still very difficult to explain, however, we continue to recommend trading for an increase and not trying to guess when and where a downward trend will occur.

Now it is necessary to understand in more detail what happened this weekend and what will happen now? As we saw from the first reaction of the market, the US dollar began to rise in price. This means that traders rushed to buy the US currency, just as in March, when no one understood why the US currency was getting more expensive when the "coronavirus" was raging around the world. The US dollar is considered by many in the world as a reserve currency. Therefore, if the cataclysm does not occur in America, then the dollar tends to become more expensive because everyone buys it to save the cost of money. Thus, yesterday we saw exactly this reaction of traders. Another question is that it ended very quickly. But this point is already interesting. Why did the markets stop buying the dollar after just 12 hours? Because the new strain of "coronavirus" is not so dangerous? Because the world already knows how to deal with the pandemic? Because the COVID-2019 vaccine already exists? In any case, it's too early to panic. And at the same time, you can also panic.

The crux of the problem is that the new strain of the virus is a different virus than COVID-2019. They can be of the same family, however, this does not mean that they are similar. Most likely, this does not mean that the vaccine against COVID-2019 will work against the new strain. Scientists have already identified three factors that determine the new strain. First, it displaces other strains of the same virus. Second, mutations occur in the most important parts of the virus. Third, some mutations show an increased ability to enter human cells. In principle, it has already been stated by British scientists that the new strain is 70% more contagious than the usual "coronavirus". That is, it will spread faster and will be much more difficult to contain.

What is the danger of the new strain of "coronavirus" for the economy and the foreign exchange market? Potentially the same as the usual COVID-2019. If after some time it turns out that it is not possible to stop the spread of a new strain called NS501Y, and the vaccine against the usual "coronavirus" does not work against it, this may simply be the beginning of a new pandemic. The whole world may again be covered by a new disease, against which we will again have to look for a vaccine. Maybe it will take less than 9 months, but still, some time will pass. At the same time, humanity will be vaccinated against the "usual COVID" and simultaneously become infected and sick with the "new COVID". The UK has already increased quarantine, and many countries around the world have simply closed any communication with the infected Foggy Albion. Now let's imagine that the "new COVID" has already broken out of Britain. After all, cases of this particular strain have already been reported in Denmark, Germany, Australia, Austria, and other countries. That is, this virus has already broken out of Britain, which means that now everything will depend on how contagious it is. If so, as British scientists say, then we are waiting for the next wave of the epidemic.

Well, the economy is waiting for new "lockdowns", new quarantines, new cuts, new falls, and all that we have seen over the past 9 months. There is no doubt that the economies of the European Union and the United States will again suffer losses, although in America everything will depend now on the new President Joe Biden. Donald Trump ignored the "old COVID" by all means, but Joe Biden, on the contrary, repeatedly called for a "hard" quarantine and stop the spread of the "Chinese infection" at all costs. Thus, if the Europeans introduce a "lockdown", then in the United States - it is still unclear. However, there will still be losses and losses. So there are reasons to panic, however, it is better to try to look at the situation soberly and wait for official information about the new strain instead of starting to panic right now. When it becomes known that a new strain is a new epidemic or a new "wave", then will it be possible to take certain measures.

From a technical point of view, the euro/dollar pair has only corrected and can now resume its upward movement. So far, the quotes have stopped near the Murray level of "+1/8"-1.2268, so in the new entry, they will aim for the next Murray level of 1.2329.

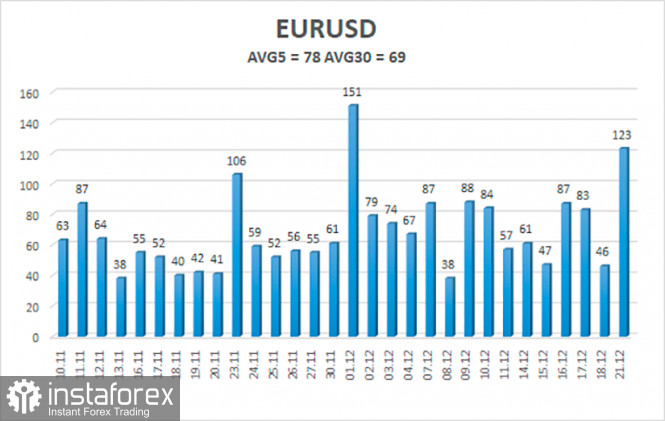

The volatility of the euro/dollar currency pair as of December 22 is 78 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2156 and 1.2312. The reversal of the Heiken Ahi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

Trading recommendations:

The EUR/USD pair is trying to resume the upward trend. Thus, today it is recommended to stay in buy orders with targets of 1.2268 and 1.2312 until the Heiken Ahi indicator turns down. It is recommended to consider sell orders if the pair is fixed below the moving average, with targets of 1.2156 and 1.2085.

The material has been provided by InstaForex Company - www.instaforex.com