On the first trading day of the new week, we will analyze the technical picture for another rather attractive currency pair - AUD/USD. Before proceeding to the analysis of the results of the past week and the forecast for the current trading five-day period, I will outline the main macroeconomic events that may affect the price dynamics of the AUD/USD currency pair. So, on Wednesday, 00:30 London time, data on Australia's GDP for the third quarter will be published, and the next day, at the same time, retail sales reports will be released. As for American statistics, then, of course, the main day will be Friday, when data on the US labor market for October will be released.

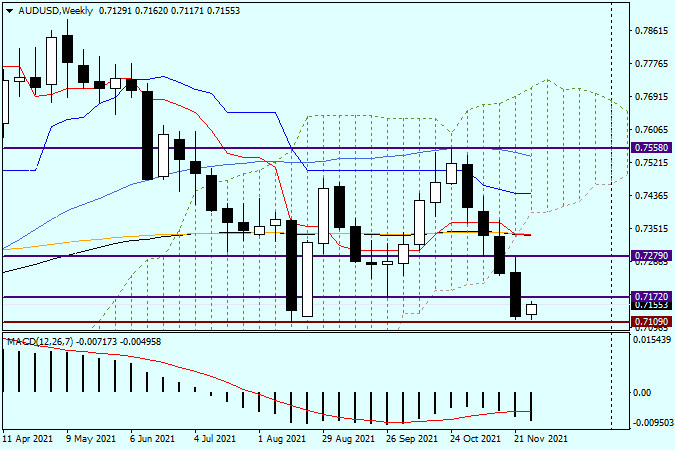

Weekly

As expected in the previous review of this currency pair, weekly trading on AUD/USD ended with a decline in the exchange rate. However, there are some, and quite important, nuances here. Despite the breakdown of the 0.7172 support level, there was no overcoming of the next support, at 0.7109. As can be seen on the chart, this level has been holding the pair back from the further downward movement since August of this year. Thus, support in the area of a strong technical level of 0.7100 can be considered key. At the time of writing this article, AUD/USD is actively growing and gives a pullback to the 0.7172 support level broken last week. If the trades of the starting five-day period close above this level, and even more so above the resistance in the area of 0.7280, this can be considered a good rebound, and maybe a reversal of the course. Bears on the "Aussie" have no choice but to break through the support at 0.7109 and close weekly trading under a strong and important technical level of 0.7100.

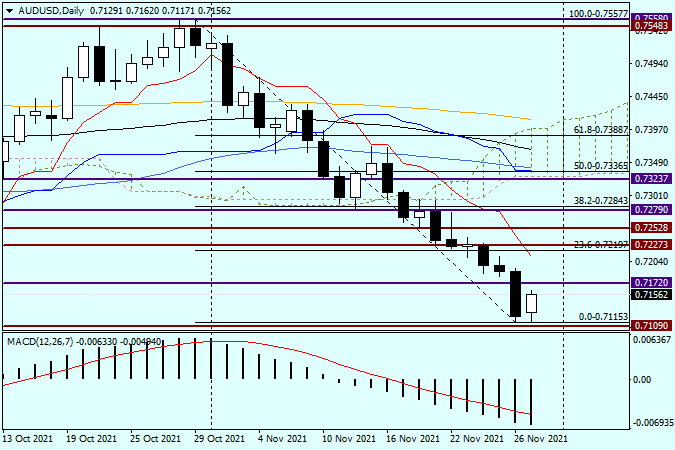

Daily

A bearish trend can be traced on the daily chart of the AUD/USD price, which will finally confirm the true breakdown of the 0.7109 support level and overcome the landmark 0.7100 mark. Despite Friday's rather strong decline in the US dollar paired with other currencies considered today, everything happened exactly the opposite for this currency pair. At the moment, there is a corrective pullback, which may stop near the broken support of 0.7172 or higher, near the level of 23.6 Fibo on the Fibonacci grid from the decline of 0.7557-0.7115. The second option, in addition to a higher price for potential sales, is also good because right below the 23.6 Fibo level, there is also a red line of the Tenkan Ichimoku indicator. I fully assume that this line will provide strong resistance to a possible price rise in this area and will turn the course in a southerly direction. Summing up, I will assume that the main trading idea for the AUD/USD pair is sales, which are safer and at more attractive prices, it is better to open after corrective pullbacks to the designated benchmarks.

The material has been provided by InstaForex Company - www.instaforex.com