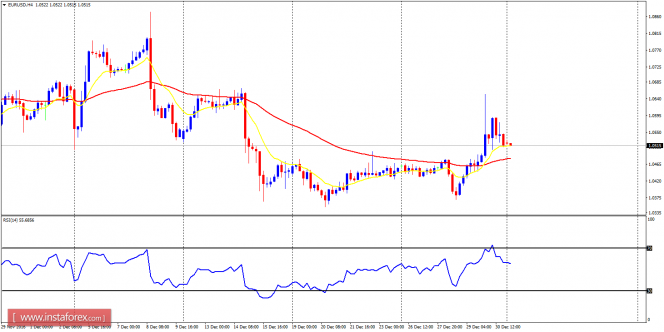

EUR/USD: Bears made an effort to push down the market further last week, but that effort was rejected at the support line of 1.0400. Price went upwards 270 pips from there, topping at 1.0653, before retracing a bit. The rally has generated a bullish signal in the market and the resistance lines at 1.0550, 1.0600 and 1.0650 could be reached this week.

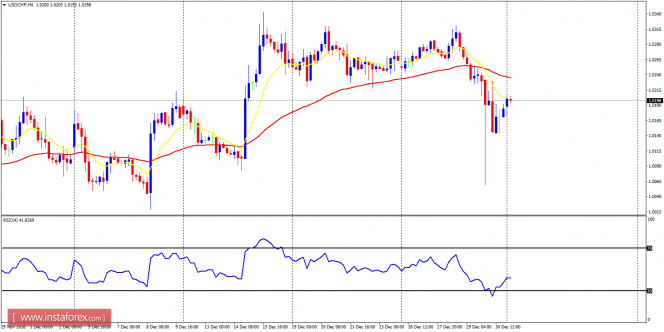

USD/CHF: This pair went upwards from Monday to Wednesday, and then began to trend downwards seriously on Wednesday. Price dropped 250 pips to reach the support level at 1.0100 (it even went below it briefly), and then bounced upwards. A bearish signal has already formed in the market and a further downwards movement is expected this week.

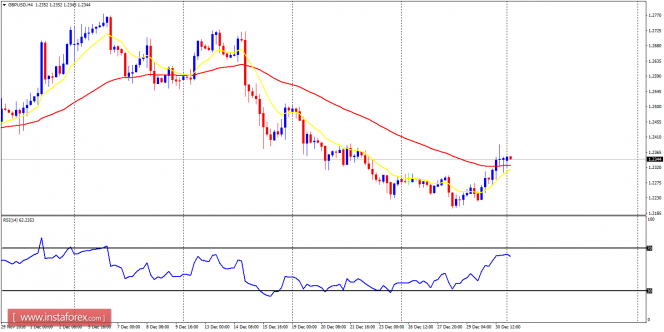

GBP/USD: The GBP/USD pair moved sideways last week, before making bullish attempt at the end of the week. The outlook is still bearish (unless the distribution territory at 1.2500 is overcome), and the distribution territories at 1.2200 and 1.2150 could be tested this week because a strong bearish movement is expected in the market.

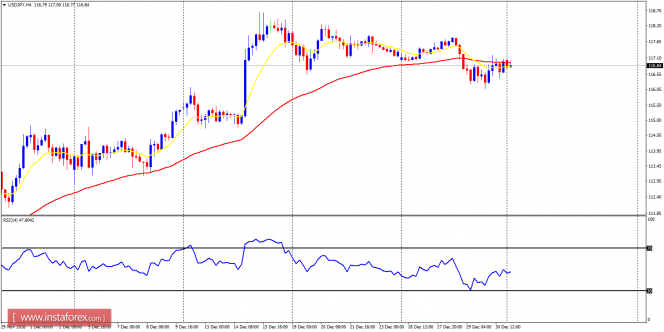

USD/JPY: The USD/JPY pair is essentially a flat market in the short term. Price simply moved sideways last week, and a closer look reveals that some bearish momentum may be coming. When a strong movement occurs, it would most likely be in favor of bears, as price goes towards the demand 116.00 and 115.50.

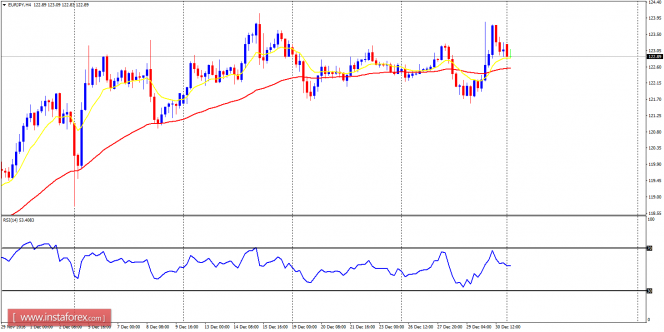

EUR/JPY: Just as it was forecasted last week, the movement of the EUR/JPY pair is determined by what happens to the EUR. Since the EUR made some bullish attempts last week, price went upwards, closing above the demand zone at 122.50, and generating a nascent bullish signal, owing to a Bullish Confirmation Pattern in the market.