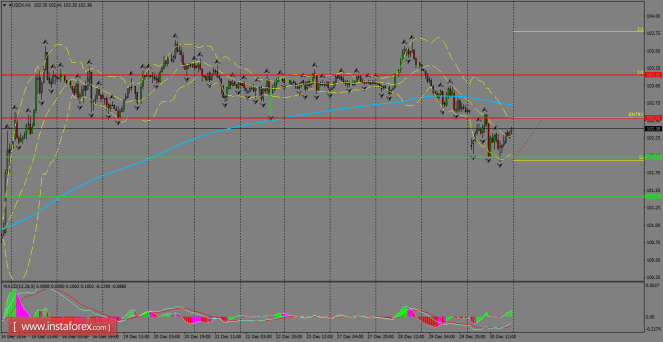

USDX stayed above the demand zone of 101.97 as it is awaiting further momentum in order to establish a clear path in the short term. It seems that the bears are favored in the current scenario because the index is consolidated below the 200 SMA on H1 chart and a breakout below that zone should help to extend the decline towards the 101.40 level.

H1 chart's resistance levels: 102.53 / 103.15

H1 chart's support levels: 101.97 / 101.40

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bullish candlestick; the resistance level is at 102.53, take profit is at 103.15 and stop loss is at 101.92.

The material has been provided by InstaForex Company - www.instaforex.com