Overview:

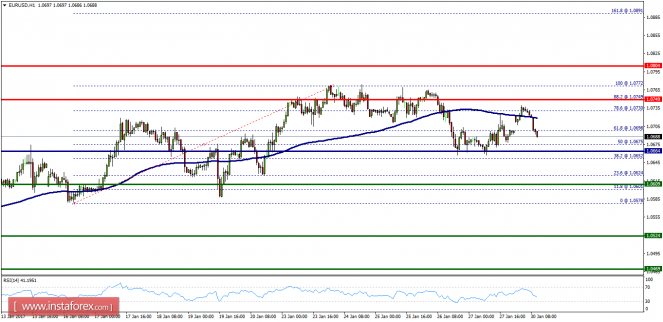

- The EUR/USD pair fell from the level of 1.0749 towards 1.0695. Now, the price is set at 1.07000. The resistance is seen at the level of 1.0749 and 1.0804. Moreover, the price area of 1.0749 and 1.0804 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Thus, amid the previous events, the price is still moving between the levels of 1.0749 and 1.0664. If the EUR/USD pair fails to break through the resistance level of 1.0664, the market will decline further to 1.0609 as as the first target. This would suggest a bearish market because the RSI indicator is still in a negative spot and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.0578 so as to test the daily double bottom. On the contrary, if a breakout takes place at the resistance level of 1.0804 this week, then this scenario may become invalidated.