Overview:

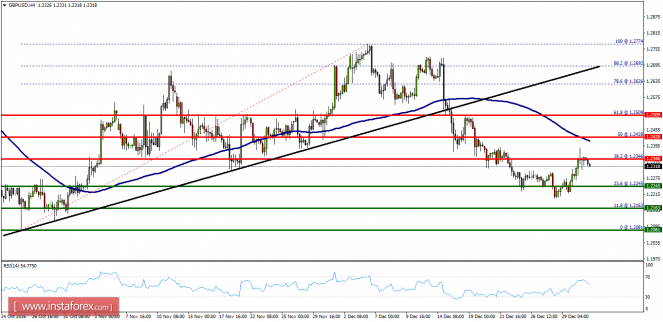

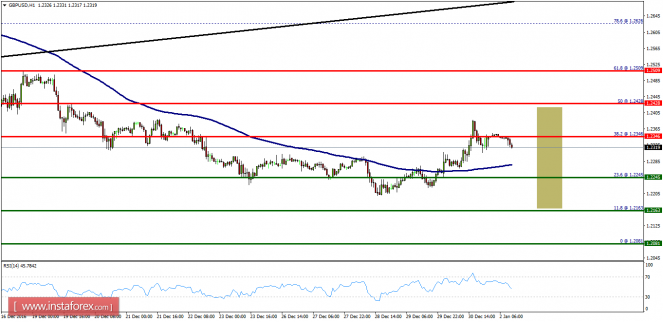

- The GBP/USD pair dropped from the level of 1.2346 to the bottom around 1.2240. Then it rebounded from the bottom of 1.2240 to reach the 1.2346 level again. Today, the first support level is seen at 1.2245, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.2346, which coincides with the 38.2% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. If the GBP/USD pair is able to break the first support at 1.2245, the market will decline further to 1.2163 in order to test the weekly support 2.

- The pair will probably go down because the downtrend is still strong. As a result, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.2346 with the first target at 1.2240 and the next one at 1.2163. At the same time, breakdown of the 1.2350 level will allow the pair to go further up to the levels of 1.2509. Overall, the pair will probably rebound again from the spot of 1.2346 as long as the level of 1.2428 is not breached. In general, we still prefer the bearish scenario below the area of 1.2428.