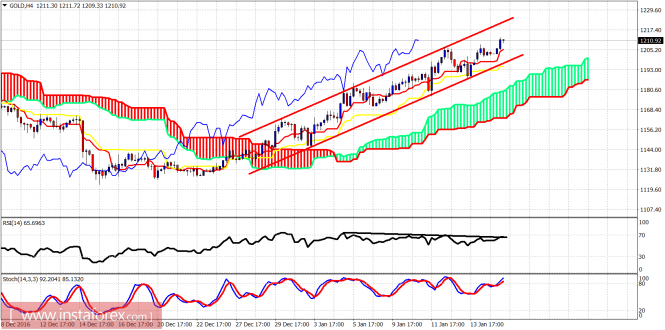

As expected, gold is making higher highs this morning as the price remains inside the bullish channel. There are several warning signs as the RSI is diverging which justifies a pullback in the short term. This pullback will be confirmed once the price breaks below $1,193.

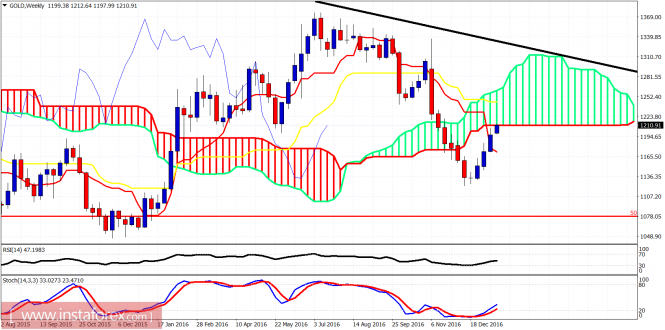

Black line - divergence

Gold price is trading above both the Tenkan- and Kijun-sen (red and yellow line indicators). Trend remains bullish in the short term. Price has reached our target at $1,200-$1,220 which acts as a key medium-term resistance. I expect a rejection from this area as there are also bearish divergence signs on the 4 hour chart.