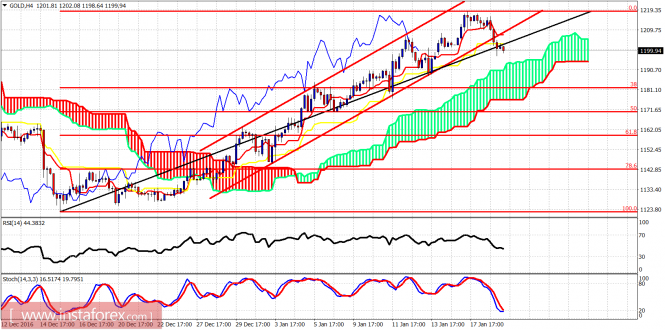

Gold price made a strong reversal yesterday, broke below $1,200 and exited the bullish channel. We could see a bounce to backtest the broken channel today but overall I believe Gold has made a short-term top and a pullback is justified towards $1,180.

Red lines - bullish channel

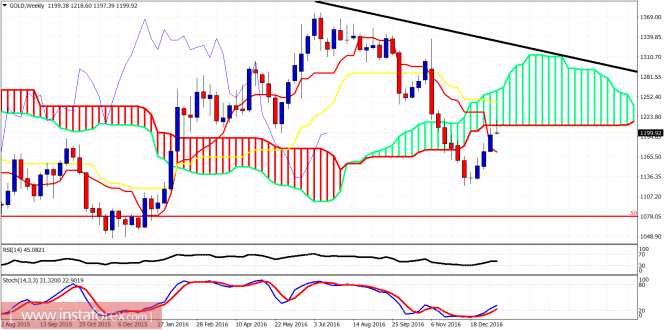

Gold continues to trade above the Ichimoku cloud but the warnings from the divergence signs in the RSI came true yesterday and we saw a reversal in price. Gold is expected to continue its pullback towards $1,180 at least. Although I remain longer-term bullish about Gold, I believe traders should wait for $1,160-70 to buy Gold again.