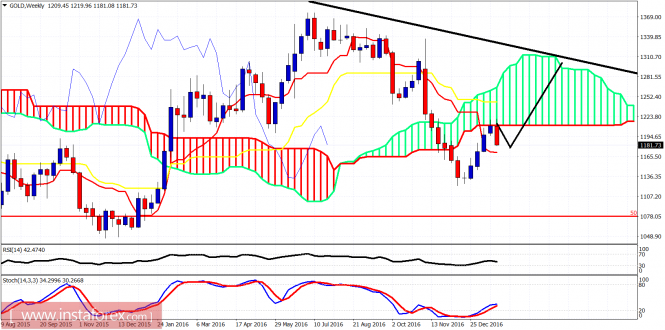

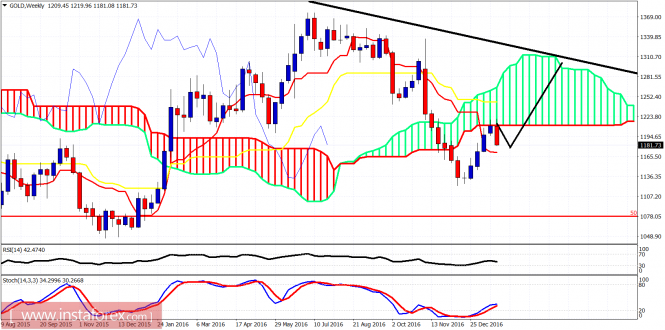

Gold has reached our first target of $1,180 where the 38% Fibonacci retracement is found. Gold could bounce back towards $1,200 but overall I expect Gold price to continue lower towards $1,160. Gold is now in a corrective phase relative to the rise from $1,122 to $1,220.

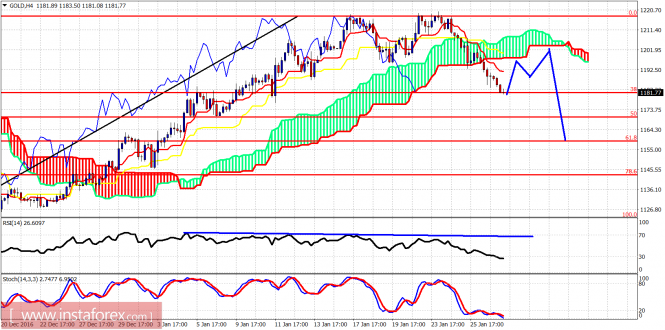

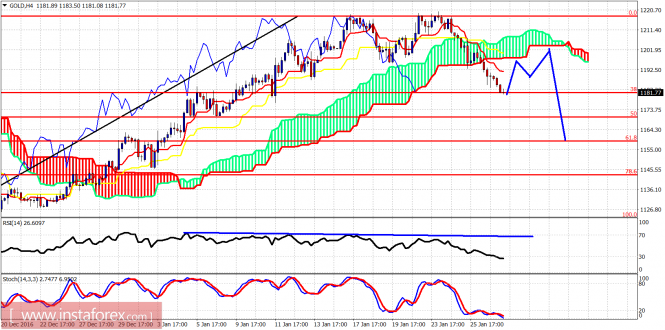

Gold is trading below the 4-hour Ichimoku cloud changing short-term trend to bearish again as we expected. Thefirst target is achieved. A bounce is justified from current levels. A backtest of the broken cloud at $1,200 is possible. However any bounce should be sold as I expect another rejection and a push lower towards $1,160. Only a break above $1,220 could change my plans.

Gold price as expected is showing strong rejection signs. The weekly candle depicts the rejection vividly. According to our previous analysis. Gold is in a corrective phase. Gold should resume the uptrend in a week or two. First we need to see $1,160. Short-term resistance at $1,190. Support at $1,180 and next at $1,170.The material has been provided by InstaForex Company -

www.instaforex.com