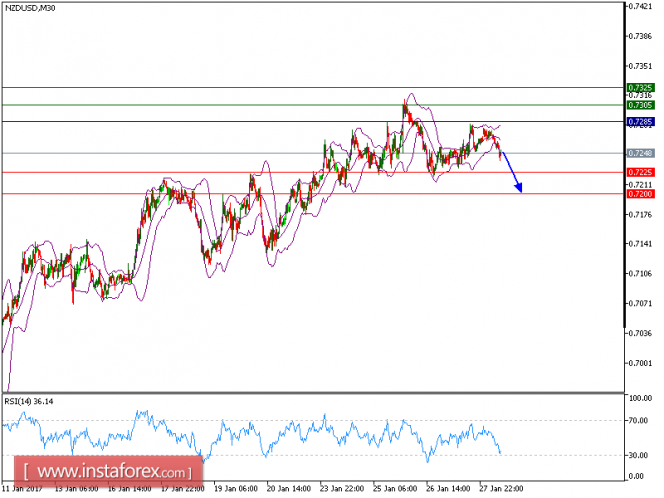

NZD/USD is expected to ttrade with bearish bias. The pair is trading below its 20-period and 50-period moving averages, which play resistance roles and maintain the bearish bias. The relative strength index is supported by a bearish trend line and is above its neutrality level at 50. Additionally, 0.7285 is playing a key resistance role, which should limit the upside potential. As long as the resistance holds at this key level, look for a further downside to 0.7225 and even 0.7200 in extension.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 0.7225. A break below this target will move the pair further downwards to 0.7200. The pivot point stands at 0.7285. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 0.7305 and the second one at 0.7325.

Resistance levels: 0.7305, 0.7325, 0.7340

Support levels: 0.7225, 0.7200, 0.7175

The material has been provided by InstaForex Company - www.instaforex.com