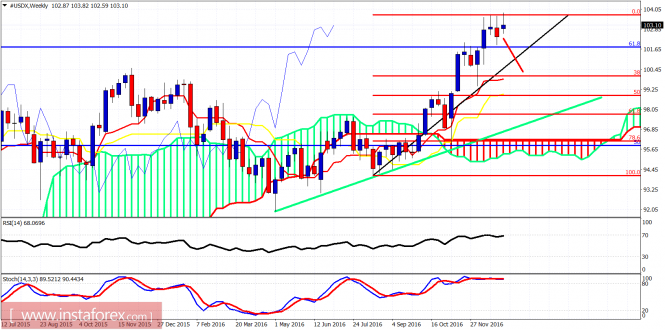

The Dollar index made a new high but it was not confirmed by the RSI. The divergence pattern in RSI during the new highs is worrying for bulls specially if price breaks below 102.20. There are a lot of chances we saw a fake breakout and rejection.

Blue line - resistance

Green line - support

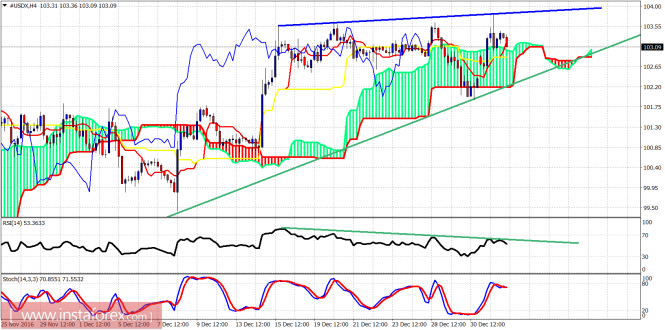

The RSI is diverging on the 4 hour chart. A break below short-term support of 102.20 will give a new stronger sell signal that will at least push prices towards the next important support at 100. So bulls should be very cautious if price breaks below the 4-hour cloud and the green trend line support.