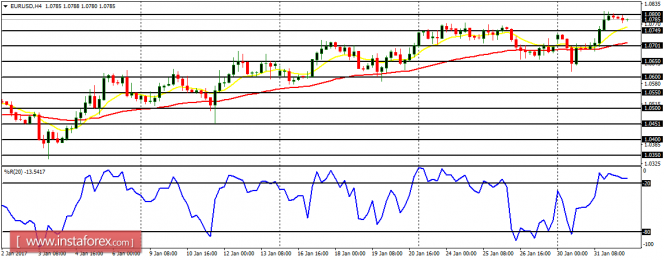

EUR/USD: In spite of the bearish correction that was witnessed on this pair, price has resumed another bullish walk. The EMA 11 is above the EMA 56 and the Williams' % Range period 20 is now in the overbought region. This means that, while a pullback is a possibility, price might likely walk further northwards.

USD/CHF: The currency trading instrument is bearish in the outlook as price has gone further downwards this week. There is a Bearish Confirmation Pattern on the chart and further downwards movement is expected since USD is facing challenges on two fronts: a strong EUR and a strong CHF.

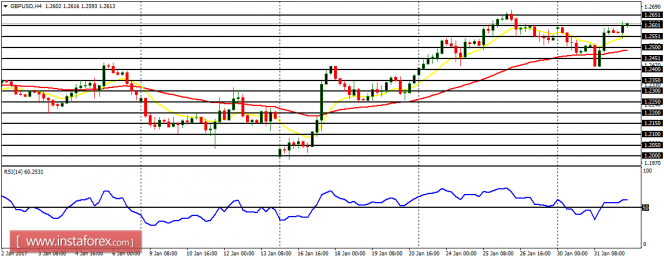

GBP/USD: The downwards movement that was seen on Monday and Tuesday has proven to be a good opportunity to go long, in conjunction with the extant bullish trend. Price is currently above the accumulation territory at 1.2600, going towards the distribution territories at 1.2650 and 1.2700. These are the targets for the week.

USD/JPY: The USD/JPY pair went down by 250 pips this week, reaching a low of 112.07. The current outlook on the market is bearish and the upward bounce may turn out to be another opportunity to sell. Price has reached a low of 112.07, and it may reach it again. That is the target for the rest of the week.

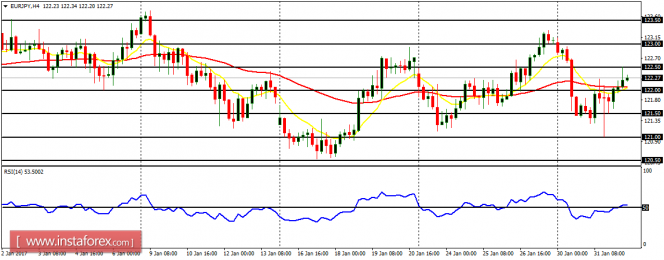

EUR/JPY: The movement of EUR/JPY was quite similar to the movement of USD/JPY. The market went down on Monday and Tuesday (amid a considerable amount of volatility), and then started moving upwards. The bias on the market is essentially neutral and a movement above the supply zone at 116.00 would result in a bullish signal, while a movement below the demand zone at 120.00 would result in a bearish signal.