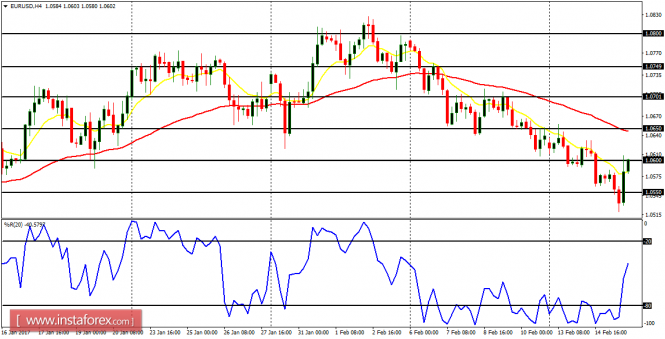

EUR/USD: The EUR/USD pair is in a bearish mode. There is a Bearish Confirmation Pattern in the market, and the price is expected to go further downwards, reaching the support lines at 1.0550 and 1.0500. The support line at 1.0550 has been tested and it could be tested again, as the price goes further downwards.

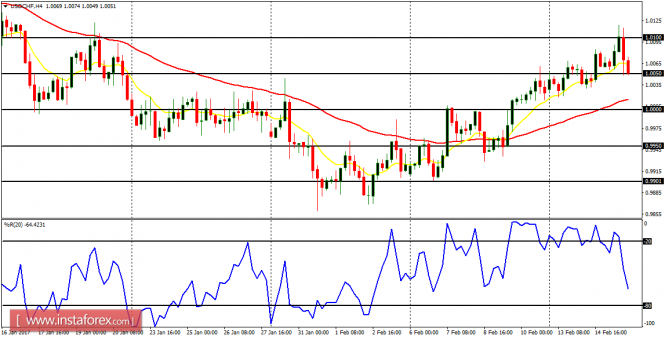

USD/CHF: The USD/CHF pair reached the resistance level at 1.0100, and then pulled back. The price has been in an uptrend, and the pullback is supposed to be temporary, as it would eventually move above the resistance level at 1.0100. The next target for this or next week is the resistance level at 1.0200.

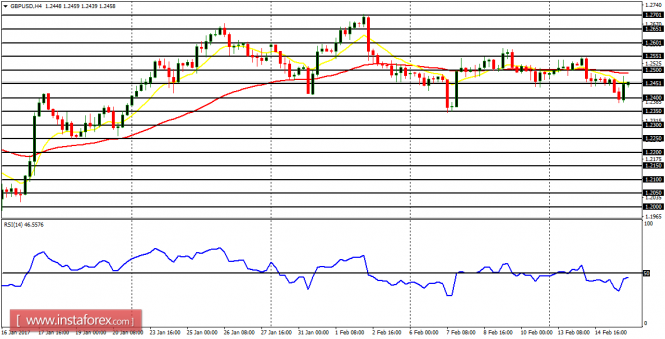

GBP/USD: The bias on the Cable remains neutral. But a rise in a bearish movement is very likely and it may happen any day. Some fundamental figures are expected today and they would have some impact on the market.

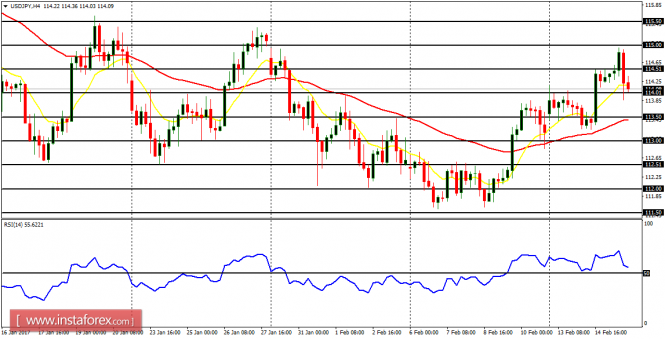

USD/JPY: The USD/JPY pair is already in a bullish mode, though that is not something very strong. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. In spite of the weakness in the bullish effort, further bullish movement is expected and the supply level at 115.00 would be hit – the price could even move beyond that supply level.

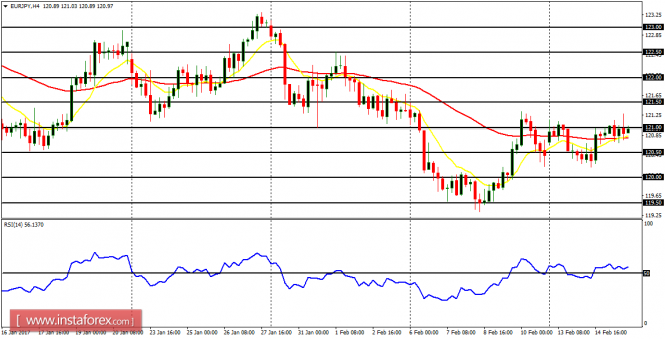

EUR/JPY: This currency trading instrument is quite choppy and directionless. It is better to stay away from the market until there would be a directional movement, which would happen before the end of this week or early next week. When the market starts trending seriously, it would be mostly in favor of the bulls.