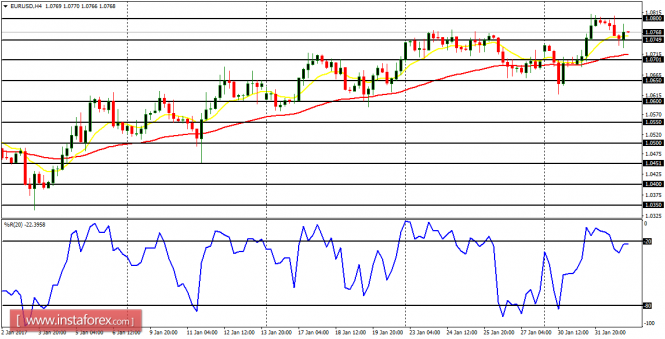

EUR/USD: The EUR/USD is bullish in outlook and price is expected to go further upwards, reaching the resistance lines at 1.0850 and 1.0900. The immediate resistance line is at 1.0800, which has been tested before and it would be tested again (and breached). Some fundamental figures are expected today and they would have impact on the market.

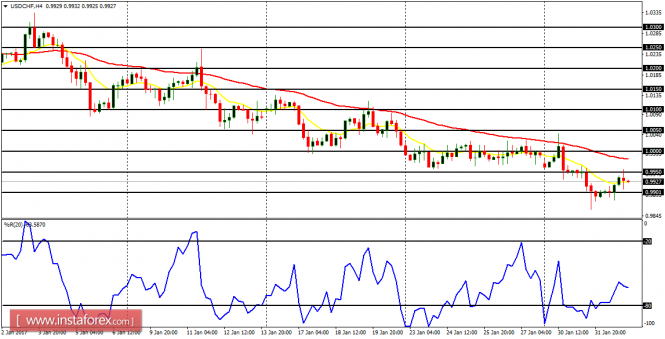

USD/CHF: The currency trading instrument is bearish in outlook – price has gone further downwards this week. Any rallies seen here – just like the shallow one currently in place – should be ignored. There is a Bearish Confirmation Pattern in the chart and further downwards movement is expected since USD is facing challenges in two fronts; a strong EUR and a strong CHF.

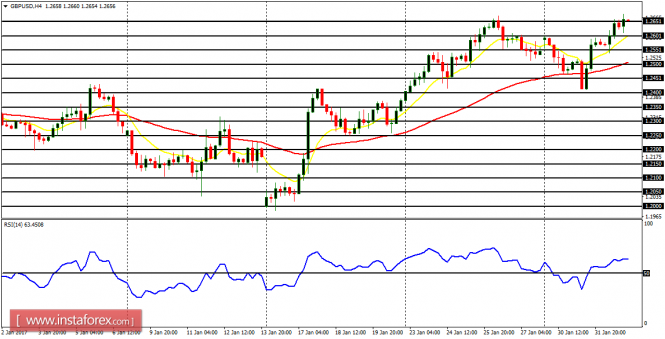

GBP/USD: On GBP/USD, the downwards movement that was seen on Monday and Tuesday has proven to be a good opportunity to go long, in conjunction with the extant bullish trend. Price is currently at accumulation territory at 1.2650, going toward the distribution territories at 1.2700 and 1.2750. These are the targets for the week. Some fundamental figures are expected today and they would have impact on the market.

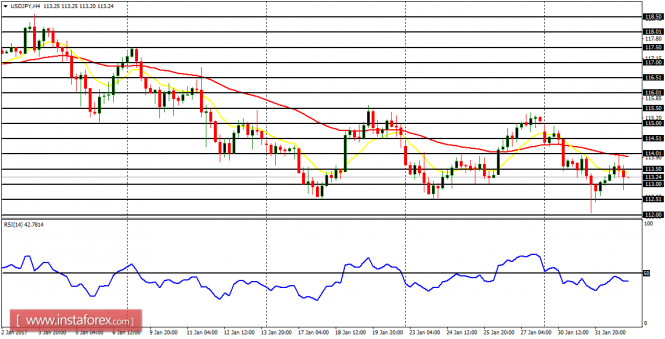

USD/JPY: No matter what bulls do here, they would only be able to move price upwards temporarily. The medium-term trend is essentially bearish, and the market is expected to continue going further and further downwards, except something drastic happens (like a fundamental factor), which changes the situation in the market.

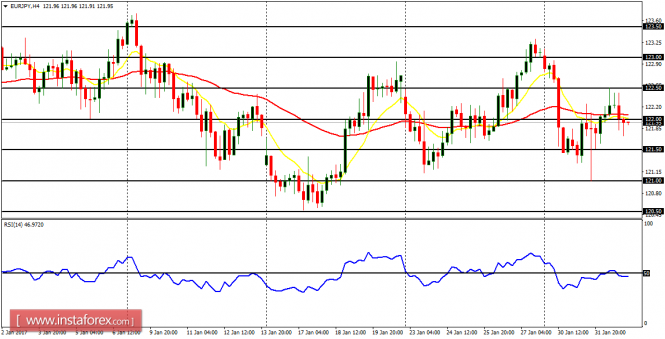

EUR/JPY: This currency cross has not moved significantly in one direction so far this week. Price has oscillated between the supply zone at 123.00 and the demand zone at 121.00. Price would need to go above the demand zone to create a bullish signal, or go below the supply zone to create a bearish signal.