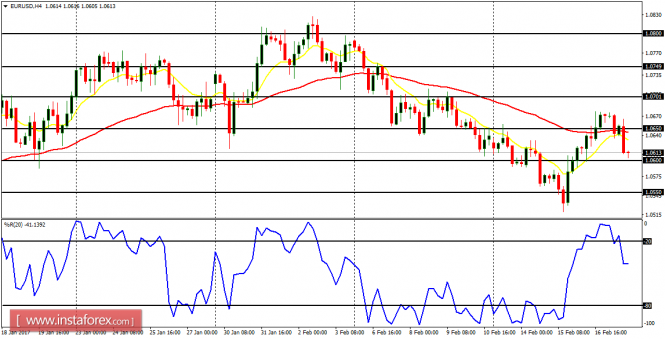

EUR/USD: The EUR/USD pair went downwards from Monday till Wednesday and later bounced upwards. The upwards bounce could be seen as a good opportunity to go short, although a movement above the resistance line at 1.0750 would threaten the bearish outlook. Right now, the price seems to be going south, and further southward movement would bring more emphasis on the bearish outlook.

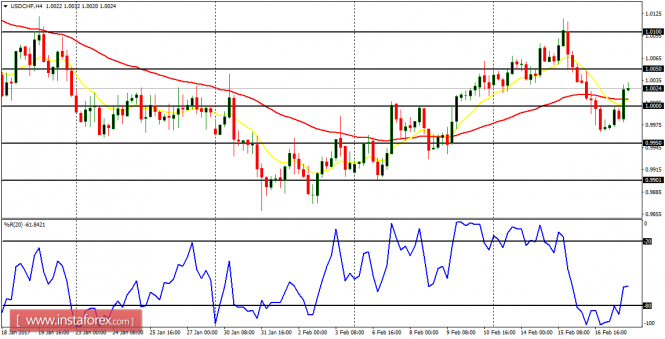

USD/CHF: Here, it can be seen that the psychological level at 1.0000 has become insignificant because the price just goes above and below it at will, while the level offers little resistance to that play. The price went below the level at 1.0000 on Thursday and then went above it on Friday. One would need to wait to see what the price would do today.

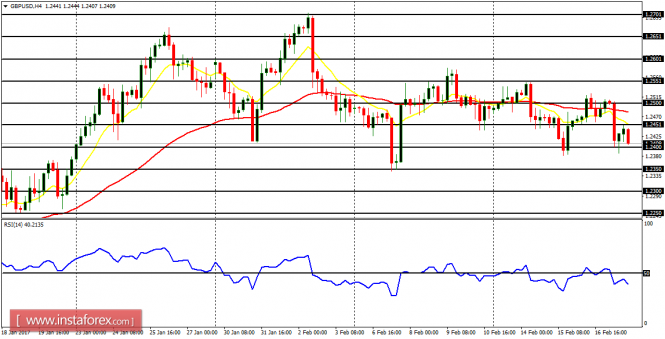

GBP/USD: The GBP/USD pair moved sideways throughout last week. However, there would soon be a serious breakout in the market, which would most probably push it to the downside, as the outlook on the GBP pairs remains bearish for February. Bullish attempts should be approached with caution here.

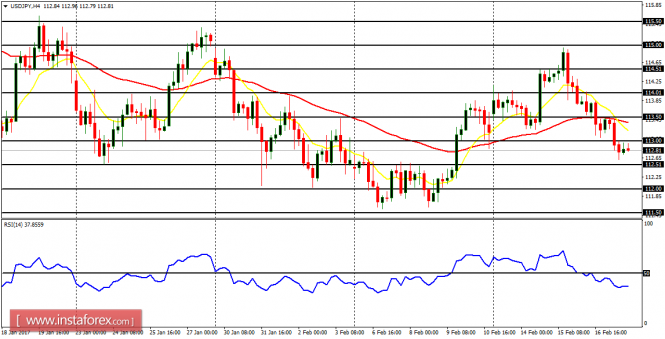

USD/JPY: This pair also went upwards from Monday to Wednesday, and then got corrected downwards. The downward correction remains in place; and if it goes further downwards, it would generate a bearish signal (which may become particularly strong once the price goes below the supply level at 112.50).

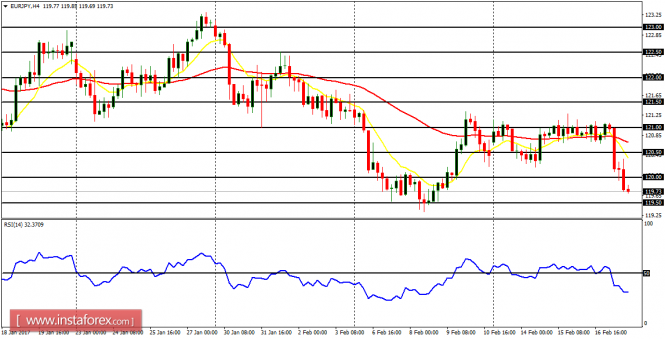

EUR/JPY: The EUR/JPY pair consolidated from Monday to Thursday and then broke out to the downside on Friday. The price closed below the supply zone at 120.00 on Friday, after generating a bearish signal, which may continue to hold out this week.