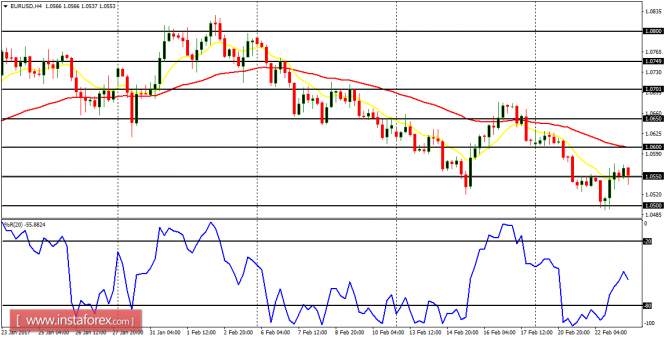

EUR/USD: The EUR/USD pair, which is in a short-term downtrend, bounced upwards yesterday. The upward bounce could end up being a good opportunity to sell short at a better price. The market could still reach the support lines at 1.0500 and 1.0450 this week.

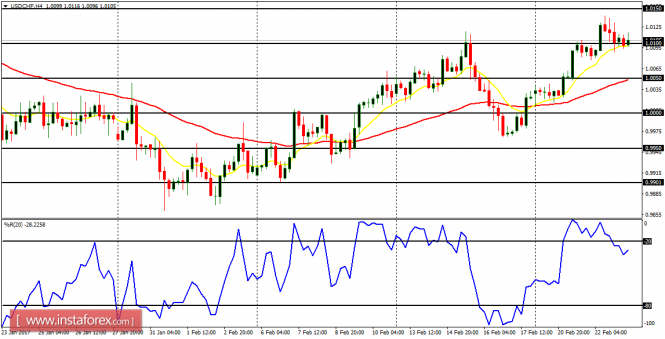

USD/CHF: The USD/CHF pair, which is in a short-term uptrend, pulled back yesterday. The pullback could end up being a good opportunity to buy long at a better price. The market could still reach the support levels at 1.0150 and 1.0200 this week. Some fundamental figures are expected today, and they may have impact on the market.

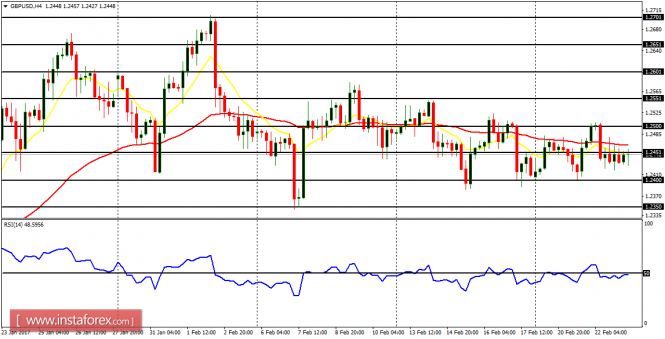

GBP/USD: The Cable has not gone upward significantly this week. The outlook on the market is neutral and the more price moves sideways, the more protracted the current base in the market. A serious breakout is imminent, and it would most probably be in favor of bears, for the outlook on some GBP pairs remains bearish for this month.

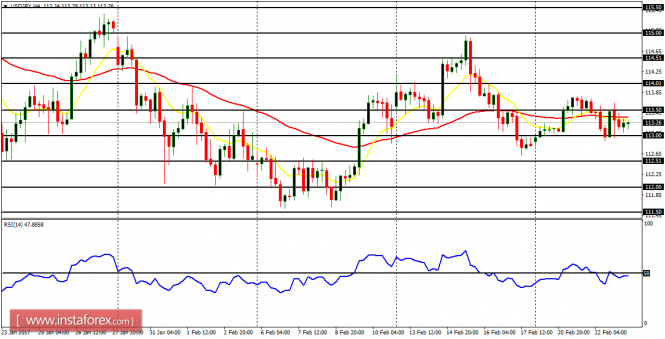

USD/JPY: This currency trading instrument is not currently attractive, for price has generally consolidated this week. In fact, it may be prudent to stay away from the market until there is a directional movement, which would most probably be in favor of bulls. A breakout can happen any day from today.

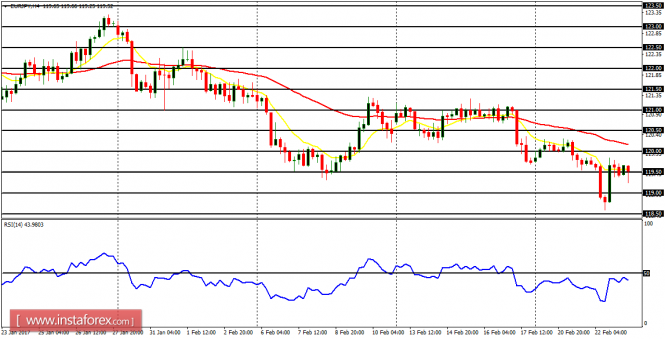

EUR/JPY: This market is in a clear downtrend (unlike its USD/JPY counterpart). There is a Bearish Confirmation Pattern in the market, as the EMA 11 is below the EMA 56. The RSI period 14 is below the level 50, suggesting that further downward movement is a possibility. Only an upward movement of at least, 300 pips, would render the bearish bias invalid.