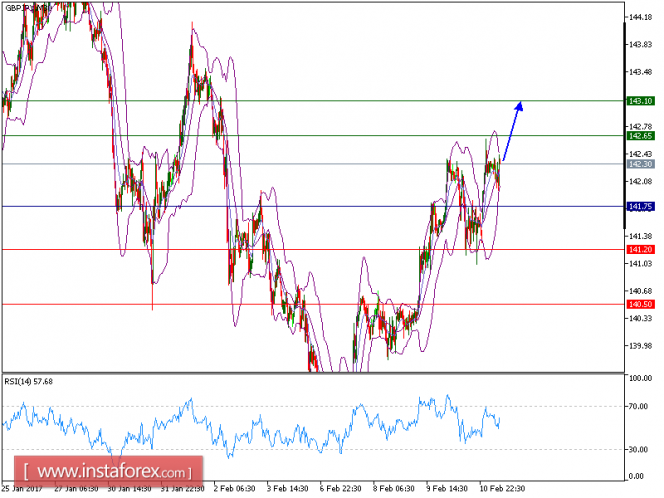

GBP/JPY is expected to trade. The pair is accelerating on the upside following the release of Japan's GDP figure, and is expected to break above its previous high at 142.65. The cross above its 50-period moving average is a bullish technical signal, which allows for further upside. And the relative strength index is well directed, showing strong upside momentum. As long as 141.75 is not broken down, further rise is preferred with 142.65 and 143.10 as targets.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 142.65 and the second one at 143.10. In the alternative scenario, short positions are recommended with the first target at 141.20, if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 140.50. The pivot point is at 141.75.

Resistance levels: 142.65, 143.10, and 143.75

Support levels: 141.20, 140.50 and 139.90

The material has been provided by InstaForex Company - www.instaforex.com