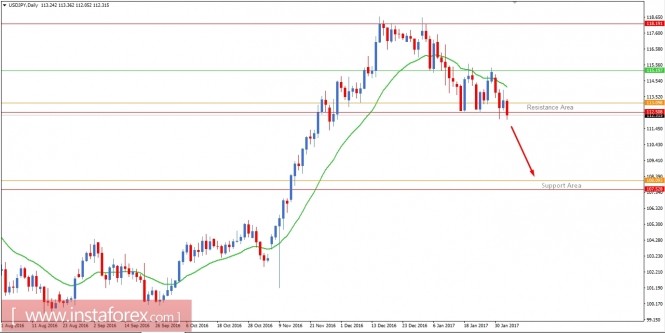

JPY has been dominating USD to a certain extent since the first day of 2017. There has been good amount of volatility since last 2 weeks in a corrective range between 112.50 and 115.20. After the FOMC meeting minutes revealed policymakers' views on the upcoming rate hike, USD showed some upward spikes, but the unchanged federal funds rate did not provide much support to the greenback. The latest unemployment claims report showed an actual figure of 246k in comparison with the forecasted 251k, the American dollar showed some bullish move but currently the market is rejecting from 112.50 area. To summarize, the USD/JPY pair is in bearish trend with a target to hit the 108.00-10 support level in nearest future. A daily close below 112.50 will confirm the upward moves in this pair.

From the technical point of view, JPY has already gained decent profits against USD after rebounding from the 118.20 area. The market is currently rejecting from the 112.50 area and making a way to break the new support which is turning to be the new resistance area. There had been quite corrective market lately which is being broken downwards with the support level at 108.00-10. If the daily candle closes below 112.50, then we will be looking for some retrace to retest the new resistance area in the nearest future to enter the market with a target at 108.00-10 support.