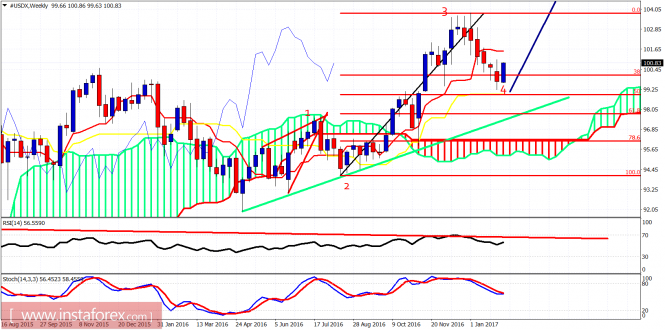

The Dollar index is making new highs and is testing short-term resistance levels at 100.80-101. This is an important resistance area. A weekly close above it will probably increase the chances that the low of wave 4 is in.

Blue line - resistance

Red line - support

The Dollar index is making higher highs and higher lows. The price has broken above the Ichimoku cloud in the 4-hour chart. This is a bullish sign. However, the form of the rise is not impulsive and that is why I continue to believe that this bounce is still a part of the corrective decline from 103.70 and I continue to expect a move towards 99.

Red line - bearish weekly divergence

Blue line - projected path ahead

My favorite scenario that the decline from 103.70 is wave 4 remains valid. The price is showing reversal signs on a weekly basis. The price is bouncing off the 38% Fibonacci retracement. As long as the price is above 100, the low of wave 4 is most probably in. Next we should expect a move towards 105. The scenario of new lows before the reversal is still valid but with less chances now. Traders need to be very cautious at this stage until we get more information.

The material has been provided by InstaForex Company - www.instaforex.com