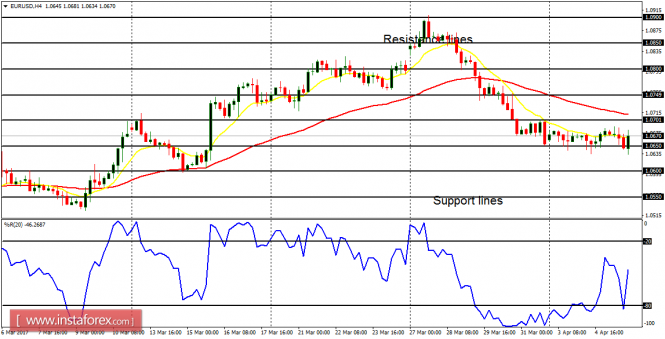

EUR/USD: The EUR/USD pair has been moving only sideways this week, but a breakout is imminent, which may happen any moment from today to next week. When the breakout occurs, it would most probably be in favor of the bears, for the outlook on the market is bearish. The current consolidation may be a temporary pause in the context of a short-term downtrend.

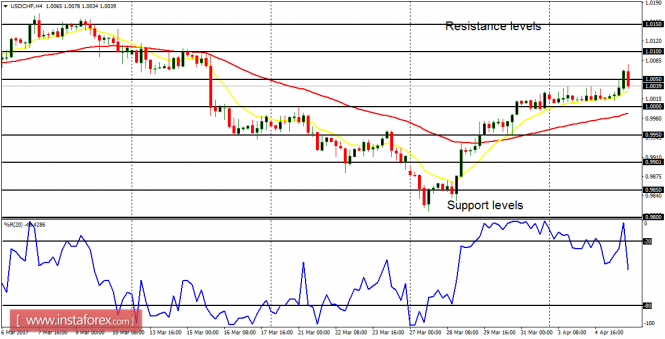

USD/CHF: This pair went sideways from Monday till Tuesday and then went upwards yesterday. The upwards movement of yesterday was not significant but it corroborated the upwards movement that started last week. Some fundamental figures are expected today and they may have impact on the market.

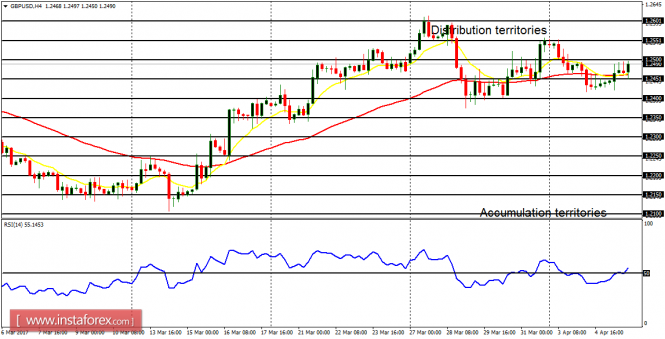

GBP/USD: The cable has largely moved sideways this week, while the outlook on the market remains bullish. There would soon be some momentum in the market, which would most probably be in favor of the bulls. The targets for this week remain at the distribution territories at 1.2500, 1.2550, and 1.2600.

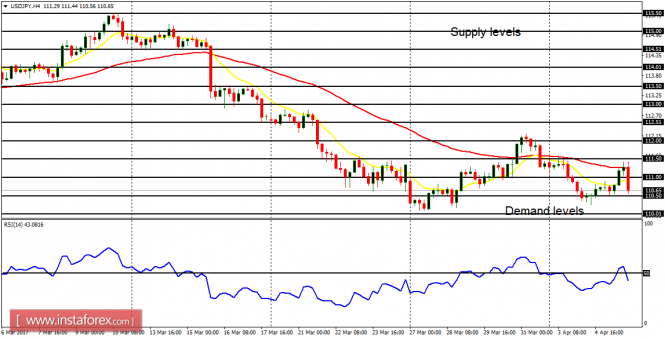

USD/JPY: What happened yesterday was another confirmation of the bearish signal in the market. The Bearish Confirmation Pattern in the 4-hour chart points to the fact that there is some selling pressure in the market. When momentum rises in the market, it is expected that the demand levels at 110.50, 110.00, and 109.50 would be tested.

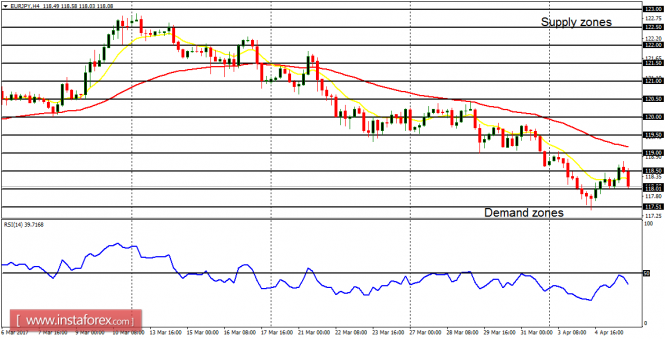

EUR/JPY: This is a bear market. The EMA 11 is below the EMA 56 and the RSI period 14 is below the level 50. While there may be occasional rallies in the market – which would be transitory – it is generally expected that price would continue its bearish movement. This is rational in the face of the weakness in Euro and the expected weakness on some JPY pairs.

from www.instaforex.com