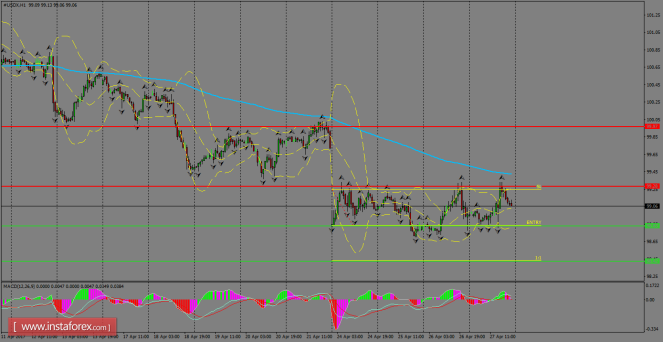

The index is now capped by the resistance level of 99.28, as the bulls are trying to gather enough bullish momentum to perform a breakout to the upside. However, a pullback might happen to re-test the support area of 98.83. The 200 SMA on H1 chart remains an active dynamic supply zone to cap further gains. MACD indicator is turning neutral, supporting a sideways tone for USDX in the coming days.

H1 chart's resistance levels: 99.28 / 99.97

H1 chart's support levels: 98.83 / 98.42

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 98.83, take profit is at 98.42 and stop loss is at 99.24.

The material has been provided by InstaForex Company - www.instaforex.com