In Asia, Japan will release the Housing Starts y/y, Retail Sales y/y, Prelim Industrial Production m/m, Unemployment Rate, Tokyo Core CPI y/y, National Core CPI y/y, and Household Spending y/y. The US will present a series of economic data such as Revised UoM Inflation Expectations, Revised UoM Consumer Sentiment, Chicago PMI, Employment Cost Index q/q, Flash GDP Price Index q/q, and Flash GDP q/q. So there is a probability the USD/JPY pair will move with low to medium volatility during this day.

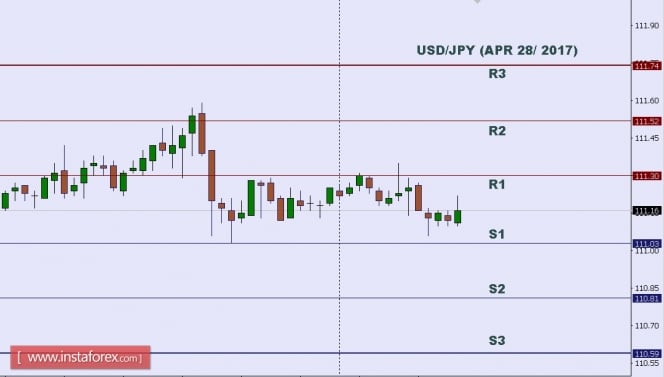

TODAY'S TECHNICAL LEVELS:

Resistance 3: 111.74.

Resistance 2: 111.52.

Resistance 1: 111.30.

Support 1: 111.03.

Support 2: 110.81.

Support 3: 110.59.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The material has been provided by InstaForex Company - www.instaforex.com