Trading plan for 03/04/2017:

The opening of the week brings undecided trades with the USD at mid-rate. Weak data from Australia and China will pull down AUD with European currencies doing best. The stock market starts a quarter of gains, oil and gold are stable.

The trading on the 3rd of April will be dominated with the PMI Manufacturing news that will be released during the trading sessions from across the Eurozone, United Kingdom and the United States.

EUR/USD analysis for 03/04/2017:

The most important PMI Manufacturing data for the whole Eurozone is scheduled for release at 08:00 am GMT. The market participants do not expect any surprises here as the anticipated number is still at the level of 56.3 points. It means that this sector of the economy is still expending and business conditions are increasing. Please notice that manufacturing is responsible for almost a quarter of Eurozone GDP.

Let's take a look at the EUR/USD technical picture at the H4 time frame. The market had closed at the level of 1.0651 in Friday and any violation of this level would lead to the golden trend line test around the level of 1.0635. If the data will be worse than anticipated, then the bears might even break the trend line and head towards the next technical support at the level of 1.0600.

GBP/USD analysis for 03/04/2017:

Another PMI Manufacturing data, this time for the UK, is scheduled for release at 08:00 am GMT. The market participants expect an increase from 54.6 points to 55.1 points, which means the monthly gauge of manufacturing activity in the UK will be stronger again. If the number will be better than expected, then this will be the highest PMI figure since August 2016.

Let's now take a look at the GBP/USD technical picture at H4 time frame. There is a clear bear flag trading pattern at this time frame, so as long as the swing top at the level of 1.2615 is not violated, the bias will be to the downside. Worse than expected data might accelerate the sell-off towards the next technical support at the level of 1.2453.

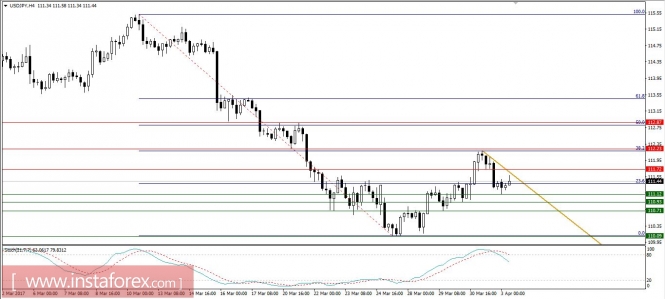

USD/JPY analysis for 03/04/201:

The last manufacturing data will be released at 02:00 pm GMT and this time it will be ISM Manufacturing data from the US. The market participants expect a slight decrease in the pace of manufacturing productivity for the last month (from 57.7 to 57.2 points), but the overall outlook for this part of the economy remains positive.

Let's now take a look at the USD/JPY technical picture at the H4 time frame. The bulls have managed to retrace 38% of the previous swing down, but the overbought market conditions suggest a temporary correction to the downside. The price is trading below the golden trend line and the next technical support is seen at the level of 111.12.

from www.instaforex.com https://www.instaforex.com/forex_analysis/90033/?x=BPDZ

via IFTTT