Trade plan for 25/04/2017:

During the Asian session, the stock market was up on the back of yesterday's optimism from Europe about the US. On the foreign exchange market, the dollar is gaining ground amid expectations of Donald Trump's political decisions (according to Wall Street Journal, Trump plans to reduce corporate tax from 35% to 15%). Gold and oil are stable.

On Tuesday 25th of April, the economic calendar is light, but global investors will keep an eye on the New Home Sales and CB Customer Confidence data from the US.

Analysis of EUR/USD for 25/04/2017:

The CB Customer Confidence data is scheduled for release at 02:00 pm GMT and the market participants anticipate that the index decreased by two points to 123.6 this month, although the projection leaves the index close to the 17-years high seen in March. The latest CB report suggests that the consumer sentiment remained high, mainly due to an increase in wages and relatively low unemployment rate. This point of view should be supported by today's data release and will eventually be good for the US dollar.

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. The bears did not manage to fill the weekend gap and now the price is bouncing back towards the next technical resistance at the level of 1.0904. Only a sustained breakout below the support at the level of 1.0820 might change the bullish bias. If this level is violated, then the next important support is seen at the level of 1.0777.

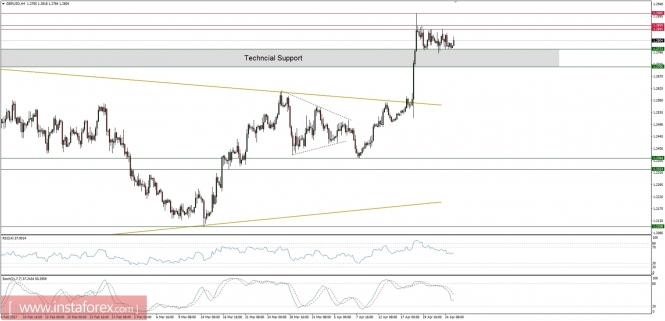

Market snapshot: GBP/USD is still consolidating the recent gains

The GBP/USD pair is trading sideways in horizontal range, still consolidating the gains. The technical support at the level of 1.2772 remains the most important support for bulls. The momentum still points to the downside, but the market conditions are becoming slightly oversold. The next important resistance is seen at 1.2845 and 1.2859.

Market snapshot: USD/JPY trading around the trend line

The USD/JPY pair is trading just below the golden trend line around the level of 110.50 as the bulls are preparing for a breakout. The weekend gap is still not filled and the market conditions look overbought on the H4 timeframe. This is why the breakout above the trend line might be a fake one and if it is so, then the price might try to fill the gap again. The key intraday support is at the level of 109.57.