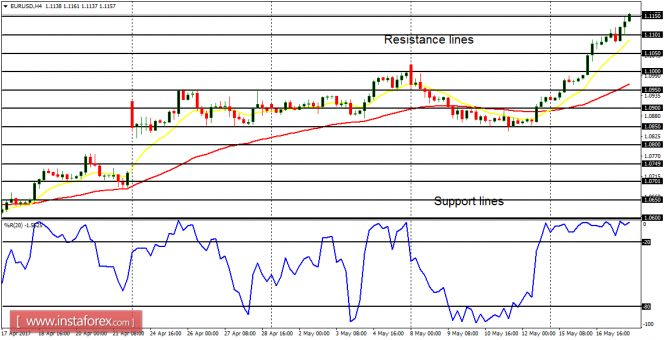

EUR/USD: There is a Bullish Confirmation Pattern in the EUR/USD 4-hour chart. Price has gone upwards by 250 pips this week, and it is currently above the support line at 1.1150, targeting the resistance lines at 1.1200 and 1.1250. Some fundamental figures are expected today and they may have impact on the market.

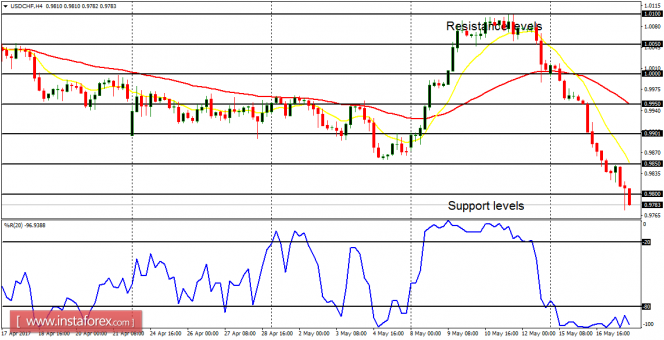

USD/CHF: There is a Bearish Confirmation Pattern on the USD/CHF 4-hour chart. The price has dropped 220 pips this week, and it has dropped 290 pips since last Friday. The pair is currently below the resistance level at 0.9800, going towards the support level at 0.9750 (which is the first target). That support level might even be breached to the downside.

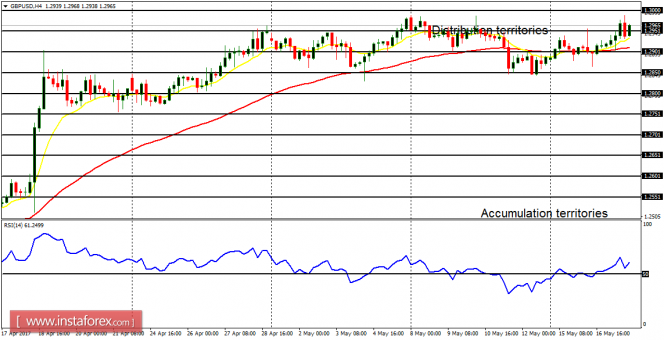

GBP/USD: This currency trading instrument is neutral in the medium-term and bullish in the short-term. The distribution territories at 1.3000 could be tested, and a movement above it could result in a bullish bias on the market. Since the EUR/USD pair is currently bullish, and it is positively correlated with GBP/USD, it is expected that the cable will be pulled upwards very soon. The long-term bias is bullish.

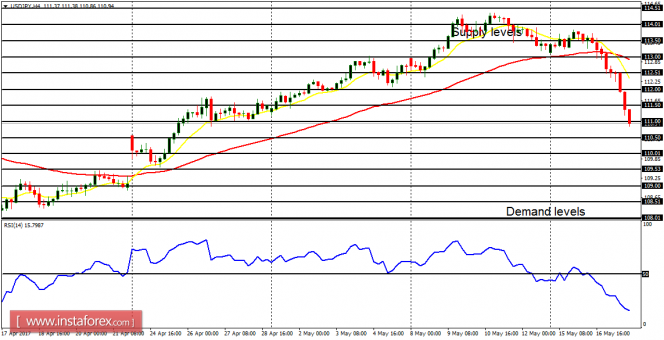

USD/JPY: This pair has dropped 250 pips this week, leading to strong bearish outlook on the market. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. There is a heavy selling pressure in the market, and further drop is anticipated as bears target the demand levels at 110.50 and 110.00.

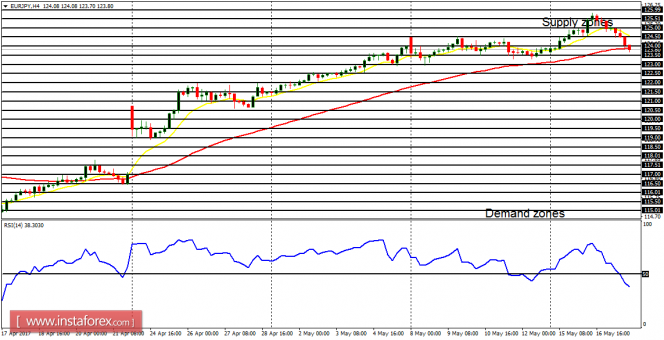

EUR/JPY: The bearish correction that was seen here on Tuesday and Wednesday, has become a threat to the recent bullish bias on the market. One factor that is currently helping the recent bullish bias on the market is the stamina in the EUR itself. A movement of about 200 pips to the downside would lead to a bearish signal in the market, and more and more bearish movement would be seen.