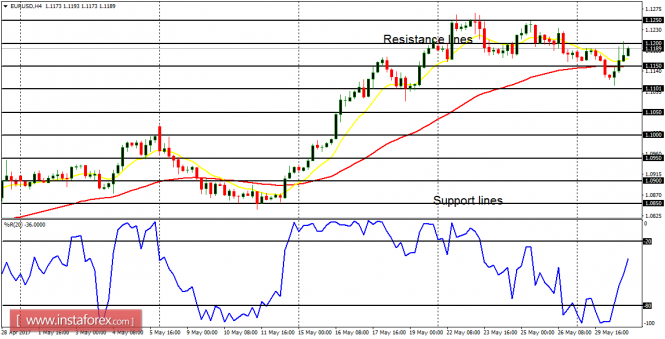

EUR/USD: This pair made a faint bearish attempt on Monday, and then rallied slightly on Tuesday. Needless to say, the rally was helpful enough to help restore the recent bullish bias on the market. There are possibilities of price reaching the resistance lines at 1.1250 and 1.1300 today or tomorrow. However, things would eventually come down.

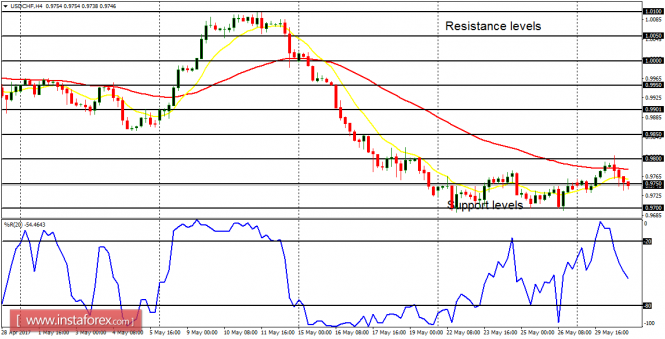

USD/CHF: The shallow rally that was seen on Monday has been rejected as soon as price rammed into the EMA 56. Price has been corrected lower. The outlook on the market is bearish, and it would be difficult for price to go seriously upwards this week (in spite of the imminent weakness of EUR/USD); owing to the expected weakness in the Greenback and the expected stamina in CHF.

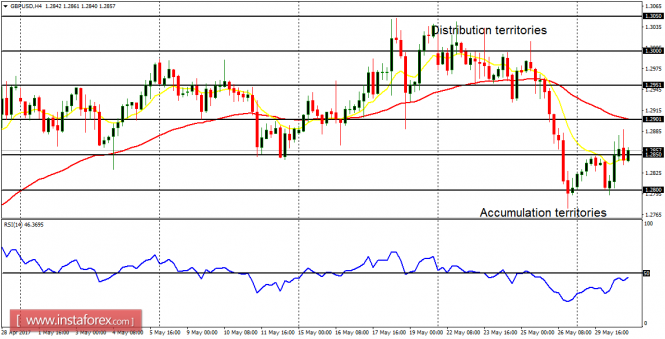

GBP/USD: On Monday and Tuesday, there was a weak rally in the context of a downtrend, and that would turn out to be another good opportunity to sell short. Price might reach the accumulation territories at 1.2800, 1.2750, and 1.2700 this week, as it goes more and more bearish. That is the current outlook on GBP/USD.

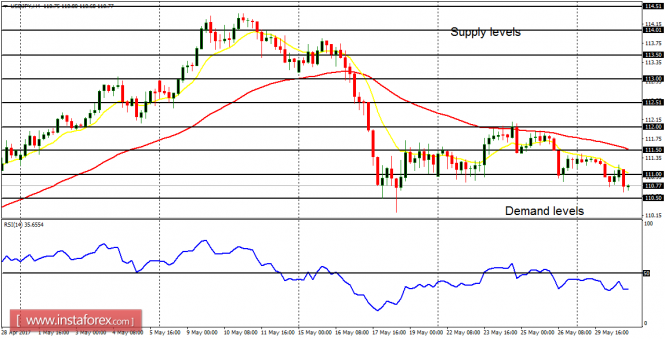

USD/JPY: This is a bear market – though things are currently consolidating. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. When momentum returns to the market, it would most probably be in favor of bears. After all, the outlook on JPY pairs is generally bearish for June.

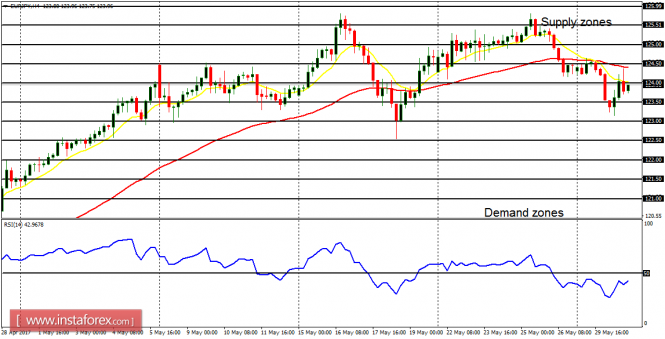

EUR/JPY: Although the market is currently fluctuating, a short-term bearish signal has been generated on EUR/JPY. The fluctuation would continue this week, as the market goes gradually southward, forming a Bearish Confirmation Pattern on the 4-hour chart. The demand zones 123.50, 123.00, and 122.50, could be tested this week