Overview:

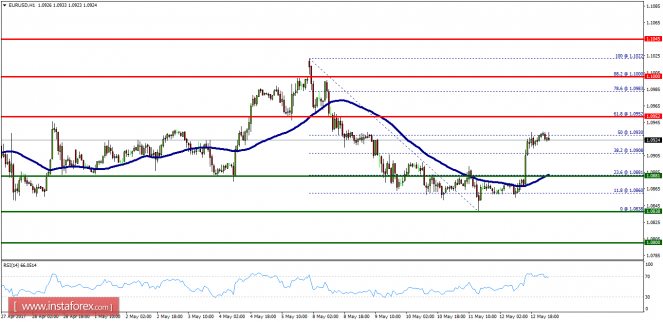

- The EUR/USD pair continues to move upwards from the level of 1.0881. Last week, the pair rose from the level of 1.0881 (the level of 1.0881 coincides with a ratio of 23.6% Fibonacci retracement) to a top around 1.0930. Today, the first support level is seen at 1.0881 followed by 1.0838, while daily resistance 1 is seen at 1.0952. According to the previous events, the EUR/USD pair is still moving between the levels of 1.0881 and 1.0952; for that we expect a range of 71pips (1.0952 - 1.0881) at least. On the one-hour chart, immediate resistance is seen at 1.0952, which coincides with a ratio of 61.8% Fibonacci retracement. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100) and (50), Therefore, if the trend is able to break out through the first resistance level of 1.0952, we should see the pair climbing towards the second daily resistance at 1.1000 to test it. It would also be wise to consider where to place stop loss; this should be set below the second support of 1.0838