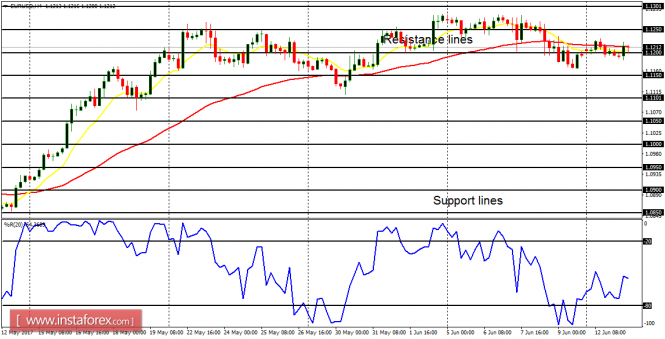

EUR/USD: The outlook on EUR pairs is bearish this week, though the market has only moved sideways so far this week. More bearish movement may be witnessed this week, when volatility rises, which would put an end to the current bullish, but that would be when the support lines at 1.1050 and 1.1000 are breached to the downside.

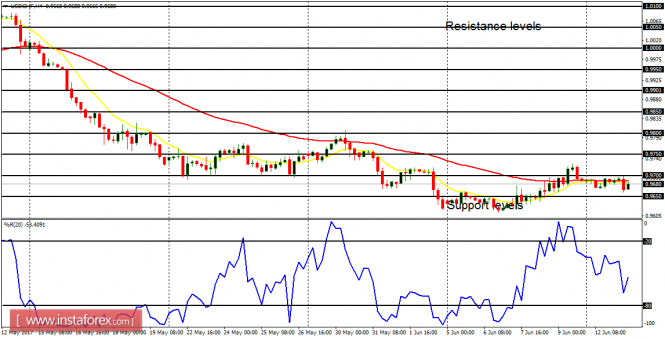

USD/CHF: The USD/CHF pair did not do anything significant on Monday. There would soon be a rise in momentum, as USD could become weak versus other currencies like CHF, AUD and NZD, which means price would go down towards the support levels at 0.9650 and 0.9600. This pair cannot go up unless EUR/USD crashes.

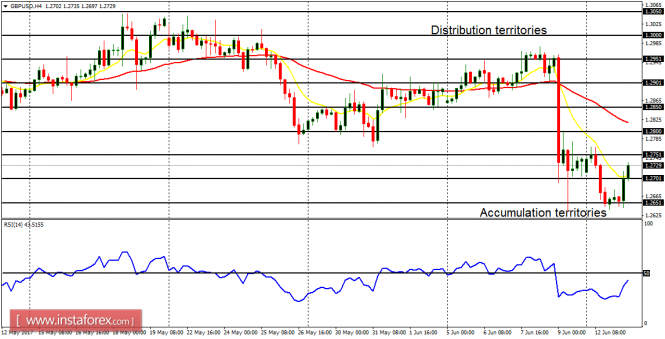

GBP/USD: The GBP/USD pair is currently bouncing upwards in the context of a downtrend. Price tested the accumulation territory at 1.2650 yesterday and it has now gone above the accumulation territory at 1.2700, targeting the distribution territory at 1.2750. This kind of action is normally seen as a rally in the context of a downtrend, which cannot be overridden unless the distribution territory at 1.3000 is overcome.

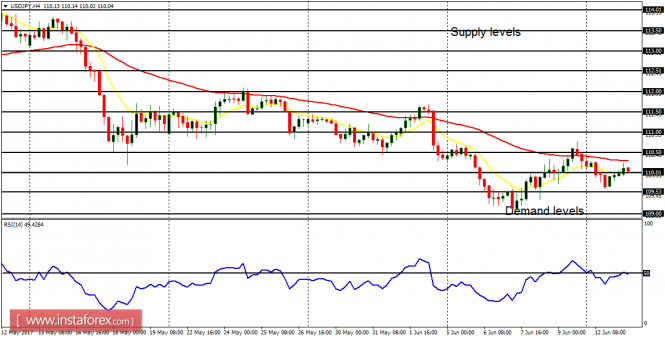

USD/JPY: There is a Bearish Confirmation Pattern on the USD/JPY 4-hour chart. The outlook on the JPY pairs is bearish for this week, and for this month. Therefore, when there is volatility in the market, it would most probably favor bears, as price is expected to go further southwards, strengthening the existing bullish bias.

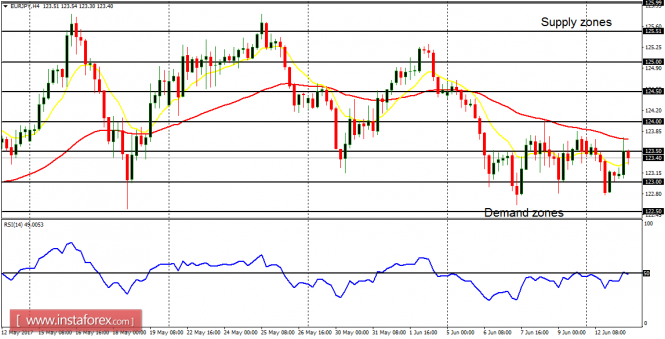

EUR/JPY: This cross pair dropped 150 pips last week, testing the demand zone at 123.00. The market then remained volatile for the rest of the week, and it has remained volatile till now. This is a bear market and price is expected to go more and more southwards.