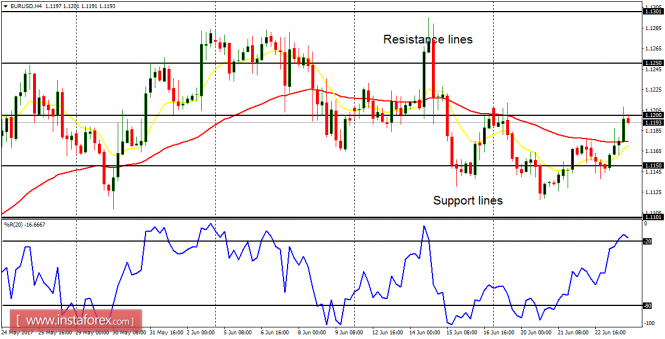

EUR/USD: The bias on EUR/USD has become neutral because the price made no significant moves last week. It was hovering between the support line at 1.1100 and the resistance line at 1.1250. There must be a movement above the mentioned resistance line or below the support line. A break above the resistance line is the most likely for this week.

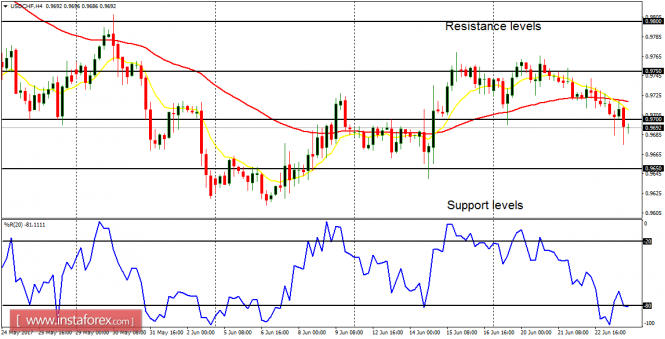

USD/CHF: This pair remains essentially in a bear market. The bearish signal that started in May 2017 is still in place, and further decline is anticipated, especially when EUR/USD goes upwards. The targets for this week are located at the support levels at 0.9650 and 0.9600.

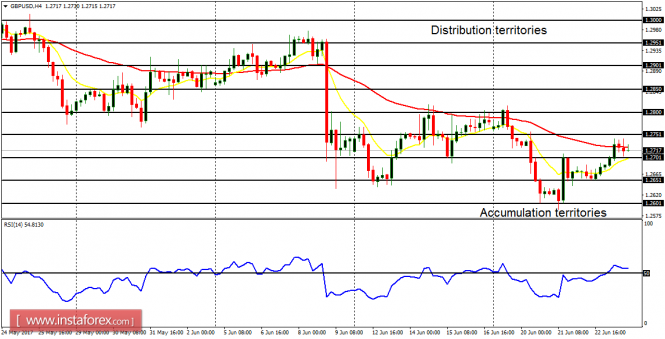

GBP/USD: This weak currency pair went downwards in the first few trading days last week to test the accumulation territory at 1.2600. After that it bounced upwards to close above the accumulation territory at 1.2700 on Friday. That upwards bounce could end up becoming a good opportunity to go short, because the market could turn downwards to test the accumulation territories at 1.2700, 1.2650 and 1.2600 this week (these are the targets since those accumulation territories were also previously tested last week). The outlook on GBP pairs remains bearish for the week.

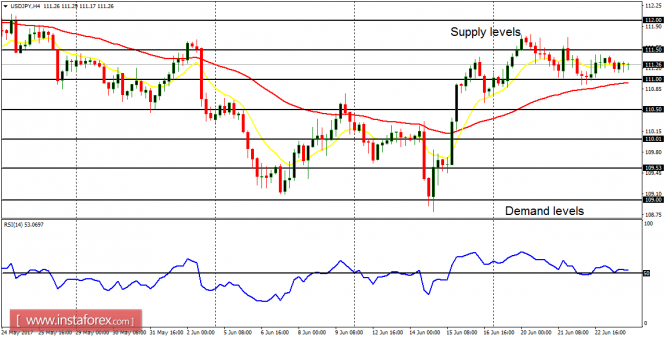

USD/JPY: This pair has become neutral, because the price could not continue going upwards to sustain the bullish signal which appeared on June 15. In fact, the price simply went sideways last week, preparing to break out upwards or downwards (downwards is more probable, because the outlook on JPY pair remains bearish for this week).

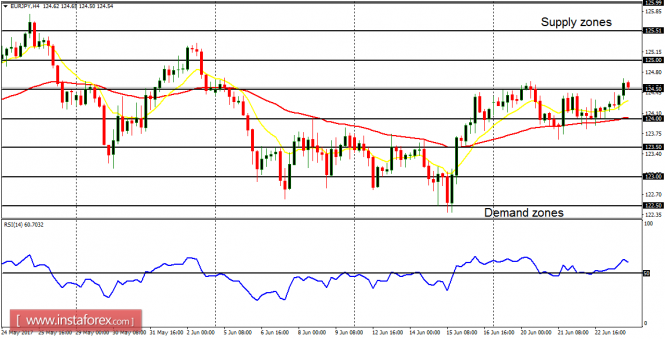

EUR/JPY: The EUR/JPY cross has been able to maintain the bullish bias that was started on June 15. The price tested the demand zone at 123.50, and then it was able to go above the demand zone at 124.50. This has revealed a bullish intention, and price could go further upwards. However, the upwards movement may not be so serious because of a possibility of a smooth bearish run before the end of the week.