The European Central Bank Chief Mario Draghi's speech yesterday further provided the euro with support. This came as the currency disclosed their upcoming monthly highs against the greenback, allowing them to reach new and larger resistance levels.

Draghi said the eurozone economy will receive backing from the increasing number of investments and productivity amid a recovery process. He added that productivity will is expecting a development because of economic improvement, which will also boost investments.

Overall, the general state of the EURUSD pair remains positive. The current break of the next high, which is 1.1420 as updated during the morning Asian session, can result to a demand for risky assets in order to meet the new annual level of 1.1470 and 1.1530. This will display a huge profit-taking after the initial rising wave of euro growth.

If sellers are able to maintain the 1.1420 range today, tomorrow will make it easier to adjust for a small correction on this month's results.

Meanwhile, in Germany, inflation data is expected to be released along with a weekly report about the US labor market. This could lead to market to heightened market fluctuations. In case the consumer price index data beats the forecasts, the demand for euro will again continue.

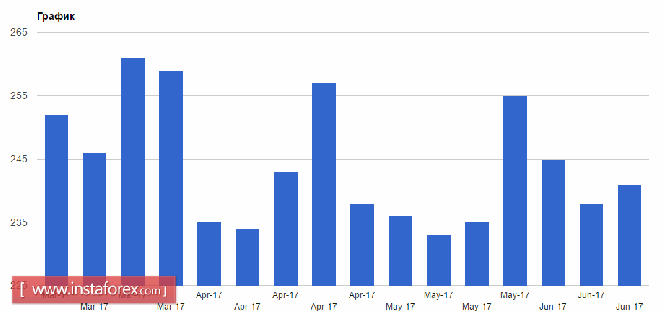

Oil quotes are interesting topic as well. After a significant decline last week, the commodity has been opting for a rebound over the past three days. Yesterday, the US Department of Energy expressed support for "black gold," as stocks issued a less-than-expected stock growth.

A report from the Energy Information Administration of the US Department of Energy cited that oil reserves hiked by 100,000 barrels from June 17-23. Gasoline stocks, on the other hand, decreased by 900,000 barrels while distillates were down by 200,000 barrels.

Nevertheless, it is considered too early to form conclusions regarding an upward trend in oil. The existing recovery quotations are more linked to the correction, which has a real basis for indicating potential growth.

The material has been provided by InstaForex Company - www.instaforex.com