AUD/USD has shown a good amount of bullish pressure on Friday after bouncing off from the support area of 0.7500-50. AUD has been quite stronger recently due to positive Employment Change and Unemployment Rate report published recently along with Positive GDP report AUD has been dominating USD till date. Today we do not have any economic event on AUD side but tomorrow we have RBA Assist Gov. Debelle to speak about key interest rates and future policies of the country which is expected to be hawkish and we have Australian HIA New Home Sales report to be published on Thursday which is expected to show some growth over the previous value of 0.8%. On the USD side, today we have Core Durable Goods Orders report which is expected to be positive at 0.4% which previously was at -0.5% and Durable Goods Orders report which is expected to show less deficit at -0.5% which previously was at -0.8%. This economic report is one of the leading indicators of the economy as rising goods orders denotes to rising manufacturing activity in the country thus the development of the economy. To sum up, AUD has been quite dominating recently and with the high impact economic report on USD to be published today a good amount of volatility is expected but AUD is expected to gain further over USD in the coming days as of the recent economic events.

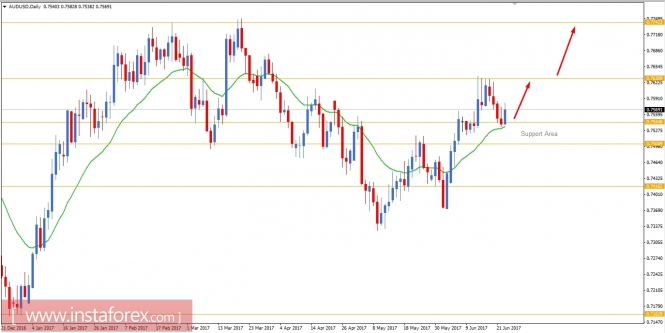

Now let us look at the technical view, the price is currently residing just above the support area of 0.7500-50 along with 20 EMA holding the price as a dynamic support level as well. As the price remains above the support area, currently the price is expected to reach 0.7630 resistance level at first and if the price breaks above the 0.7630 resistance level with a daily close then we will be looking forward to further bullish move with a target towards 0.7750 resistance level. The bullish bias is going to continue until price breaks below 0.7500 with a daily close.