Global macro overview for 07/06/2017:

The Gross Domestic Product data from Australia beat market expectations. According to the National Statistics Bureau, the first quarter GDP increased 0.3%, whicle market participants expected only a 0.2% increase. Nevertheless, on a yearly basis, GDP grew 1.7%, following a 2.4% year-over-year gain in the fourth quarter. Seventeen of twenty industries tracked by the statistics bureau reported growth. Final consumption expenditure grew at a seasonally adjusted 0.6%. However, net exports detracted 0.7% from overall growth, while investment in total dwellings fell 4.4%. This yearly decrease in GDP is seen as temporary because the most important reason behind the yearly decrease in GDP is weather conditions. Cyclone Debbie and wet weather on the East coast weighed on housing construction and exports which contribute a large chunk to the overall GDP. In conclusion, the overall economic indicators (job market, construction, business conditions) are still at elevated levels and are trending up, supporting the Australian economy in the longer term. This is why the Reserve Bank of Australia might still wait for the interest rate hike and apply the wait-and-see policy to collect more evidence for a monetary policy change. If the economy keeps performing at the current levels, the RBA might even start to hike the interest rates in the beginning of 2018, which in turn will make the Australian Dollar to appreciate more.

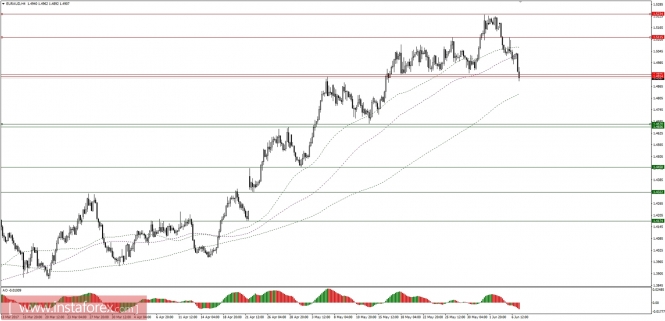

Let's now take a look at the EUR/AUD technical picture on the H4 time frame. The market is trading at the very important technical support at the level of 1.4915 and it might break out below it. If this level is clearly violated, then the next support will be seen at the level of 1.4670 - 1.4656.