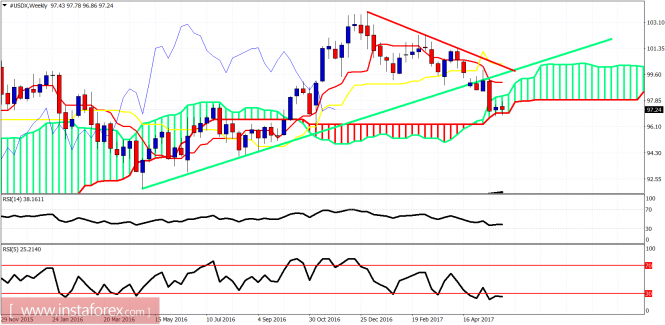

The Dollar index remains above critical support at 97. Price held support yesterday and is bouncing towards short-term resistance. Trend remains bearish and there is still no confirmation of a trend change. We could see a trend reversal today after the NFP.

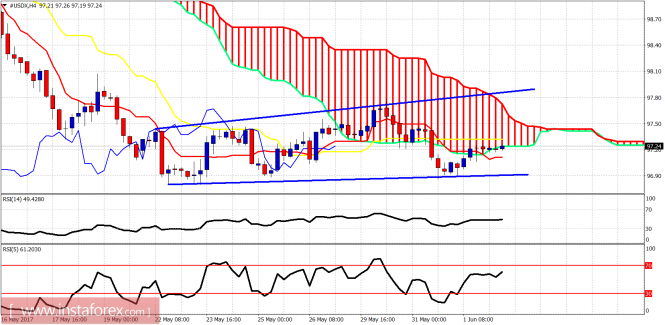

The Dollar index is trying to get back inside the neutral trend zone of the Ichimoku cloud in the 4-hour chart. Resistance is here at 97.20-97.30. Next important resistance is at 97.50. A breakout and above the cloud could be a trend reversal signal.

Green line - broken trend line support

The Dollar index is at important weekly support. A bounce of this area is expected. The target is the broken green trend line or the downward sloping red trend line. I would not be bearish on the Dollar at current levels. I would prefer to short the Dollar after a strong bounce.

The material has been provided by InstaForex Company - www.instaforex.com