Overview:

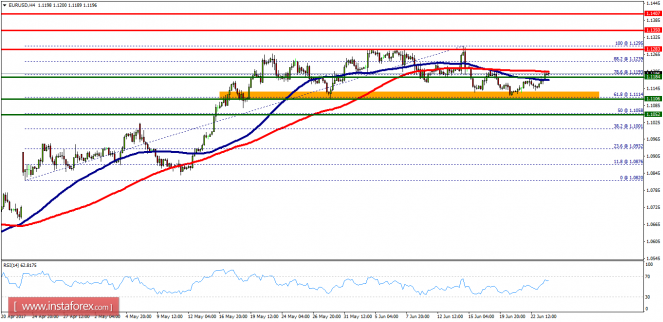

- The EUR/USD pair continues to rise from the level of 1.1184. It should be noted that the support is established at the spot of 1.1184 -1.1114, which represents the 61.8% Fibonacci retracement level on the H4 chart.

- Since the trend is above the 61.8% Fibonacci level, the market is still in an uptrend The price is likely to form a double bottom on the same time frame.

- Accordingly, the EUR/USD pair is showing signs of strength following a breakout of the highest level of 1.1240.

- So, buy above the level of 1.1240 with the first target at 1.1283 in order to test the daily resistance 1 and further to 1.1350.

- Also, notice that the level of 1.1350 is a good place to take profit because it will form a new double top.

- However, it would also be safe to consider where to place a stop loss; this should be set above the second resistance of 1.1106.

- Otherwise, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1184, a further decline to 1.1106 can occur which would indicate a bearish market.