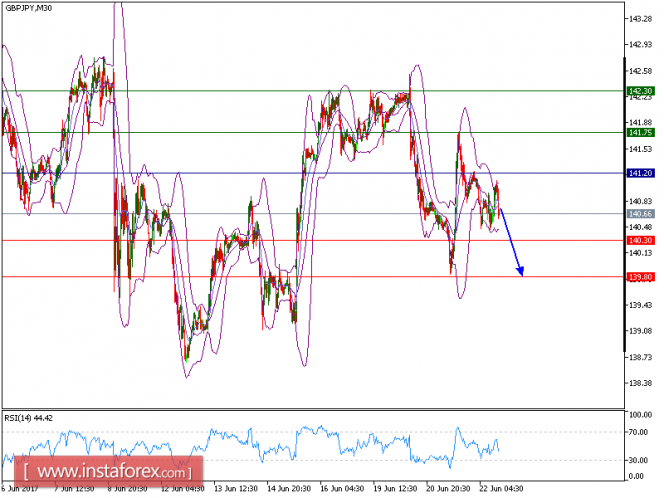

GBP/JPY is expected to trade with a bearish outlook. Despite the pair's bounce, it is still trading below the key resistance at 141.20, which should limit the upside potential. The relative strength index lacks upward momentum. Even though a continuation of technical rebound cannot be ruled out, its extent should be limited.

To conclude, below 141.20, look for a return to 140.30 and even to 139.80 in extension.

Alternatively, if the price moves in the opposite direction as predicted, a long position is recommended above 141.20 with targets at 141.75 and 142.30.

Chart Explanation: the black line shows the pivot point. The price above pivot point indicates the bullish position and when it is below pivot points, it indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 141.20, Take Profit: 140.30 and 139.80

Resistance levels: 141.75, 142.30, and 143.00

Support levels: 140.30,139.80, and 140.35

The material has been provided by InstaForex Company - www.instaforex.com