Overview:

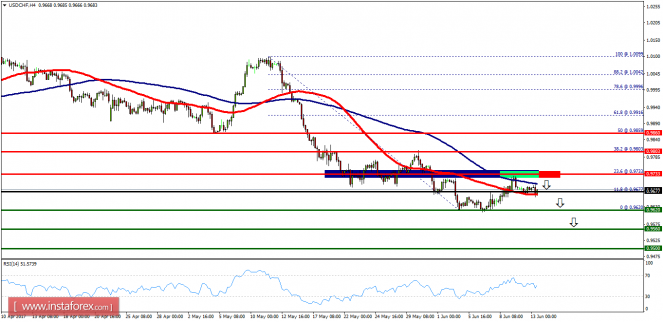

- The USD/CHF pair is still moving in a downwards from the level of 0.9733. The bottom price is seen at 0.9620. The trend has rebounded from the bottom of 0.9620 towards the level of 0.9716. So, the strong resistance has been already formed at the level of 0.9733 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 0.9733, the market will indicate a bearish opportunity below the new strong resistance level of 0.9733 (the level of 0.9733 coincides with a ratio of 23.6% Fibonacci). Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bearish opportunity below 0.9733 so it will be good to sell at 0.9733 with the first target of 0.9620. It will also call for a downtrend in order to continue towards 0.9560. The daily strong support is seen at 0.9560. However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 0.9803. Overall I still prefer a bearish scenario at this phase.