Overview:

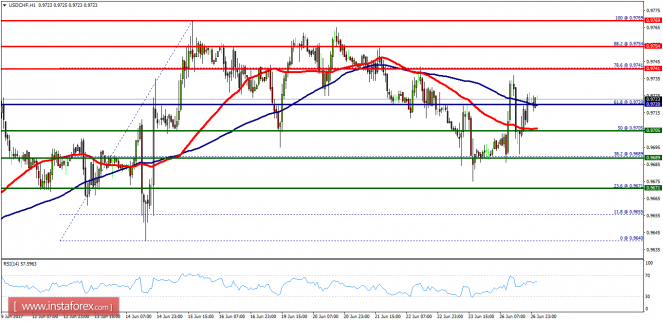

- The USD/CHF pair has broken resistance at the level of 0.9720 which acts as support now. Thus, the pair has already formed minor support at 0.9720.The strong support is seen at the level of 0.9689 because it represents the daily support 2. Equally important, the RSI and the moving average (100) are still calling for an uptrend. Therefore, the market indicates a bullish opportunity at the level of 0.9720 on the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: USD is in an uptrend and CHF is in a downtrend. Buy above the minor support of 0.9720 with the first target at 0.9741 (this price is coinciding with the ratio of 78.6% Fibonacci), and continue towards 0.9769 in order to test the double top. On the other hand, if the price closes below the minor support, the best location for the stop loss order is seen below 0.9689; hence, the price will fall into the bearish market in order to go further towards the strong support at 0.9671 to test it again. Furthermore, the level of 0.9640 will form a double bottom.