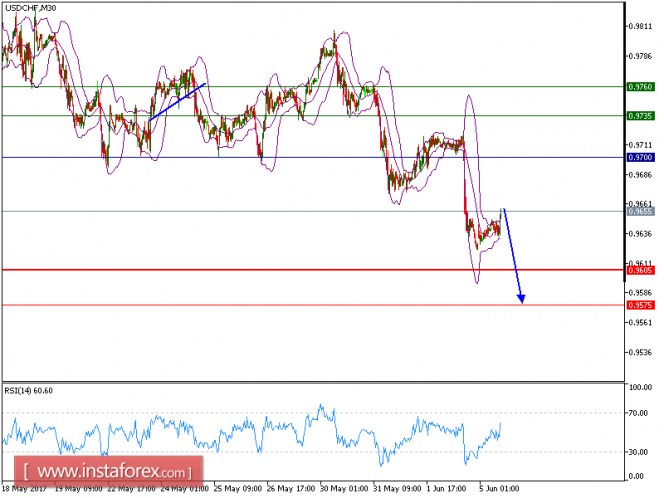

USD/CHF is under pressure. The pair broke below its 50-period moving average and consolidated on the downside, while the 50-period moving average is declining and is playing a resistance role. The relative strength index is below its neutrality level at 50 and lacks upward momentum.

The U.S. Labor Department reported that the number of nonfarm payrolls increased 138,000 in May, compared with +184,000 expected and +174,000 in April. The jobless rate, however, fell to a 16-year low of 4.3% from 4.4% in April. Average hourly earnings for private-sector workers were $26.22 an hour in May, up 4 cents on month and 2.5% on year.

As long as 0.9700 holds on the upside, look for a further drop towards 0.9605 and even 0.9575 in extension.

Graph Explanation: Black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. Red lines shows the support levels and green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL at highs, Stop Loss: 0.9700, Take Profit: 0.9605

Resistance levels: 0.9735, 0.9760, and 0.9790

Support levels: 0.9605, 0.9575, and 0.9535

The material has been provided by InstaForex Company - www.instaforex.com