Trading plan for 28/06/2017:

After yesterday's busy trading day, the mood of the Asian session was calm. The dollar is losing to other G-10 currencies today. The strongest are commodity currencies like CAD, AUD, NZD, EUR/USD after breaking above 1.1230 and 1.1300 currently trades around 1.1350. USD/JPY is in the correction phase and from yesterday's highs around 112.50 is moving back to 112.20.

On Wednesday 28th of June, the event calendar is again busy with the central banker's speeches. First to speak is Bank of Japan Governor Haruhiko Kuroda at 01:30 pm GMT. Next one to speak is Bank of Canada Governor Stephen Poloz, Bank of England Governor Mark Carney and European Central Bank President Mario Draghi. The global investors will pay attention to Goods Trade Balance and Pending Home Sales data from the US later in the session.

EUR/USD, USD/JPY and GBP/USD analysis for 28/06/2017:

The central banker's remarks have contributed to the global market shifts. ECB President Mario Draghi comments on deflation risks and inflation ease by short-term global factors have given the Euro a rather strong impulse to further strength. The President of the ECB pointed to "stronger and more widespread reflection in the euro area economy" and stated that "deflationary tendencies have been replaced by reflationary", but the European economy still needs significant support. The market read these words as a prelude to the upcoming tapering and possibility of sooner rate hikes in the Eurozone. The markets vigorously repriced Eurozone assets sending EUR/USD rocketing higher led by EURJ/PY which traded at the highest point in over a year.

An effective blow to the British banking sector was set by Mark Carney, the governor of the Bank of England, who reported on the planned increase in capital requirements. The reason behind such a statement is, that the UK is preparing for the worst case scenario regarding post-Brexit negotiations result as Mark Carney said yesterday, that the central bank is putting contingencies in place for the possibility that Britain drops out of the European Union without any deal in just under two years time.

No hawkish mentions during the speech of Janet Yellen clearly favor the Euro again. An interesting remark during the speech was made, when she said: "Can't rule out another crisis but the system is much safer. Don't expect another crisis in our lifetimes". This might suggest more confidence in FED's current monetary policy and announces more interest rate hikes and balance sheet rollover in the near future.

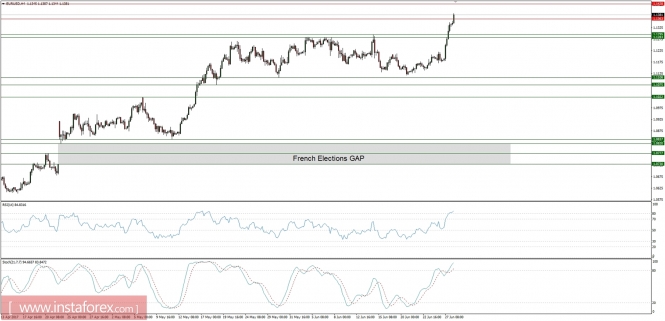

Let's now take a look at the EUR/USD, GBP/USD and USD/JPY technical picture at the H4 timeframe.

EUR/USD ripped up yesterday and currently trades around the level of 1.1380 in overbought market conditions. The next important technical resistance is seen at the level of 1.1425 at the daily timeframe. The next support is seen at the level of 1.1283 - 1.1295. The current bias is bullish, and might even get parabolic is Mario Draghi will deliver more hawkish statements during today's speech later in the day.

GBP/USD had broken above the technical resistance at the level of 1.2817 after Mark Carney remarks, but reversed at the level of 1.2680 and got back to the range zone. The market still trades below the golden trend line in overbought market conditions. The next important support is seen at the level of 1.2709.

USD/JPY had hit the 61%Fibo at the level of 112.23 and reversed back under it. The intraday high at the level of 112.46 will now act as the technical resistance as the growing bearish divergence between the pice and the momentum oscillator clearly favors the downside.The next important support is seen at the level of 111.75.