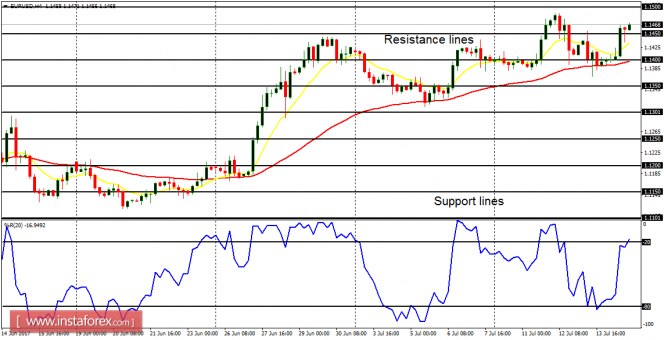

EUR/USD: This pair has been able to maintain its bullishness so far; though price moved in a zigzag manner. The pair closed above the support line of 1.1450 on July 14, now targeting the resistance line at 1.1500 (the initial target for the week). As soon as price exceeds the resistance line, it would go upwards to target additional resistance lines.

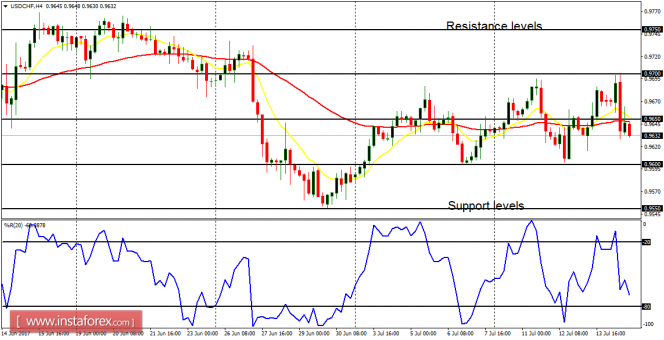

USD/CHF: This market is neutral in the short term and bearish in the long term. The neutrality in the market would continue as long as price does not go above the resistance level at 0.9750; and as long as it does not go below the support level at 0.9550. A movement above the aforementioned resistance level would result in a bullish bias, while a movement below the support level at 0.9550 would strengthen the current bearish bias.

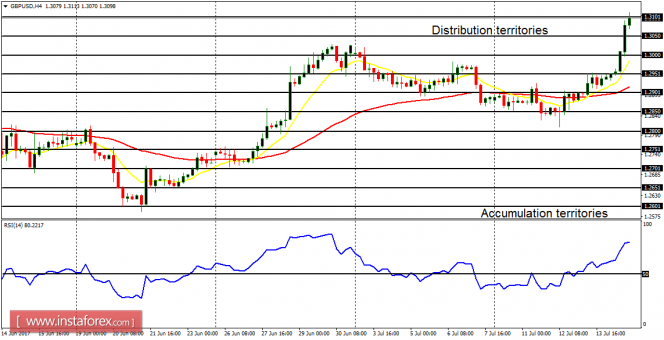

GBP/USD: The GBP/USD pair moved sideways early last week, and it shot seriously skywards in the last few days of the week. The distribution territory at 1.3100 has been tested and it would soon be breached to the upside, for price can move further upwards by 200 pips this week. The outlook on certain other GBP pairs is also bullish.

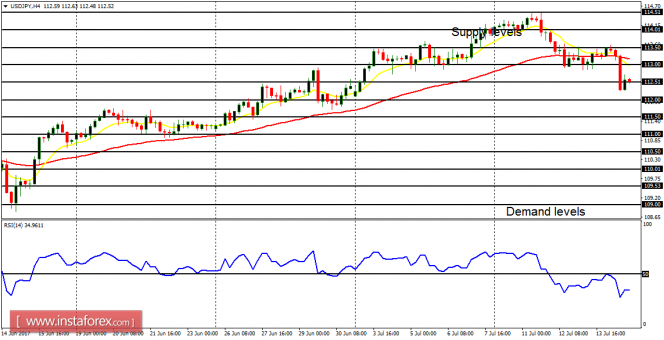

USD/JPY: The movement on this currency trading instrument was bearish last week, and that has become a threat to the recent bullish bias. Only an upwards movement from here would save the bullish bias. A movement below the demand level at 111.50 would invalidate the recent bullish bias, creating a clear "sell" signal. That is the expectation for this week.

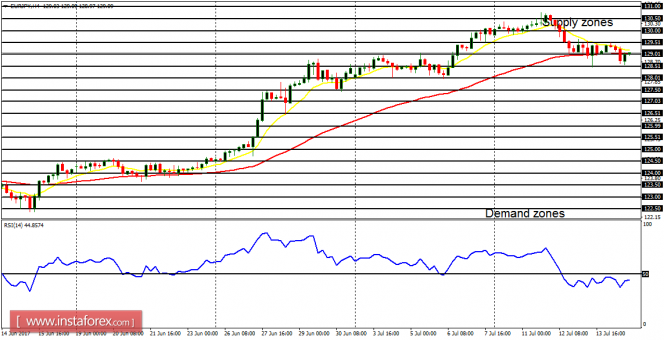

EUR/JPY: The EUR/JPY pair moved downwards last week, in the context of an uptrend. Price first went upwards to test the supply zone at 130.50, before it got corrected by 180 pips. The demand zone at 128.50 has tried to halt further correction, but price may break below it as it goes further southwards, thus invalidating the uptrend. We should bear in mind that the outlook on JPY pairs is bearish for July.