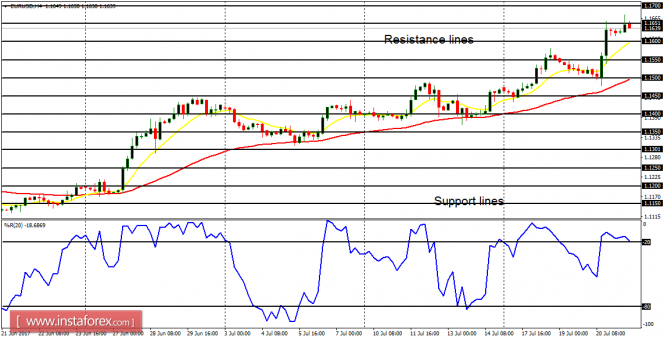

EUR/USD: On the EUR/USD pair, bulls are clear winners this week. Price has already gone above the multi-month high at 1.1600 (which was our ultimate target for the week). Since there is a strong Bullish Confirmation Pattern in the market, price would continue going further upwards until it reaches the resistance line at 1.1700.

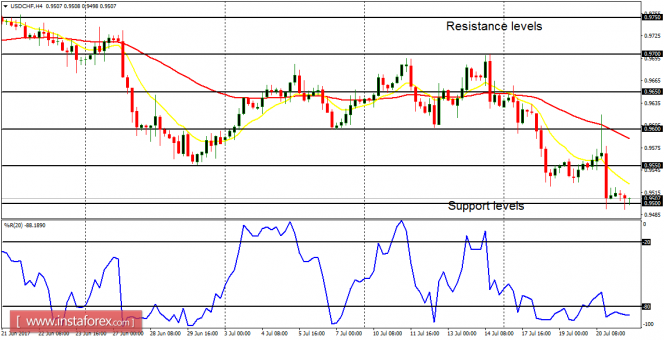

USD/CHF: This pair has fallen by 140 pips this week, now testing the support level at 0.9500. The support level would soon be breached to the downside as price targets another support levels at 0.9450 and 0.9400. The bias on the market is strongly bearish. Thus, long trades are not recommended at this time.

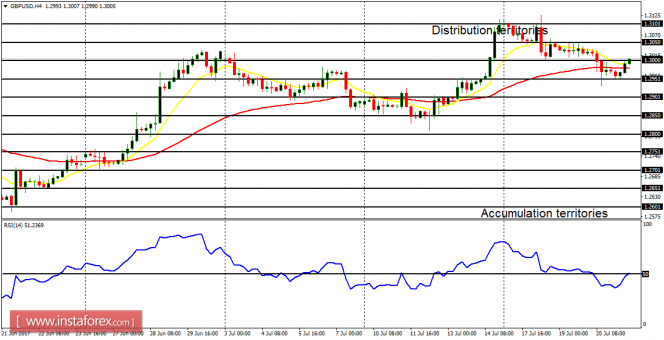

GBP/USD: In spite of the consolidation to the downside, which has been witnessed so far this week, there is still hope of a further bullish movement in this market. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. A further bullish movement might be witnessed from here.

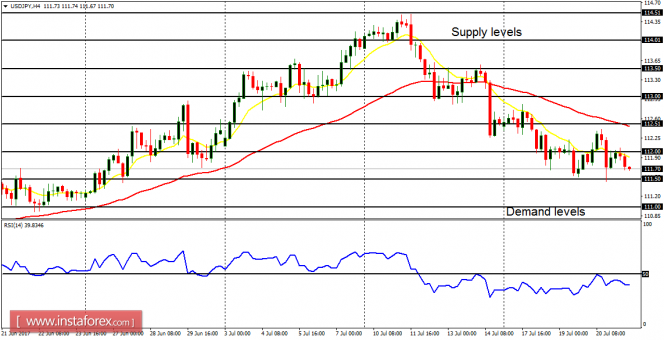

USD/JPY: There is a Bearish Confirmation Pattern in the USD/JPY 4-hour chart. Owing to the weakness of USD, the EMA 11 has crossed the EMA 56 to the downside. About 270 pips have been given up since July 11, and it is expected that the market would continue to go more and more bearish, reaching the demand levels at 111.50 and 111.00.

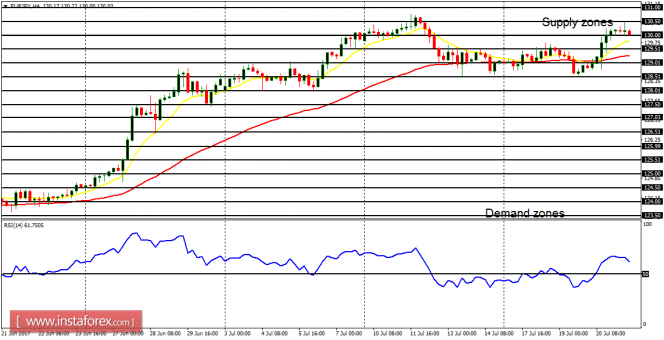

EUR/JPY: The only factor that prevents this cross pair from coming downwards is the stamina in EUR itself. The bulls have held out so far, and the bias would continue to be bullish as long as EUR is strong. The next targets for the bulls are located at supply levels at 130.00 and 130.50.