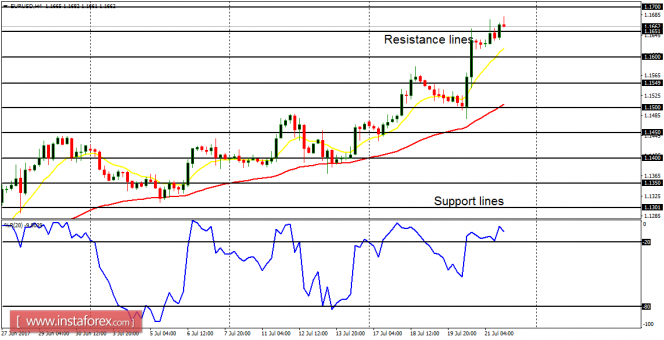

EUR/USD: On the EUR/USD, bulls are the clear winners this week. Price has already gone above the multi-month high at 1.1600, and it closed above the support line at 1.1650 on Friday. There could be further bullish movement this week, for the resistance lines at 1.1700, 1.1750 and 1.1800 could be tested this week. It should also be borne in mind that the further the market goes upwards, the more the chances of a significant pullback.

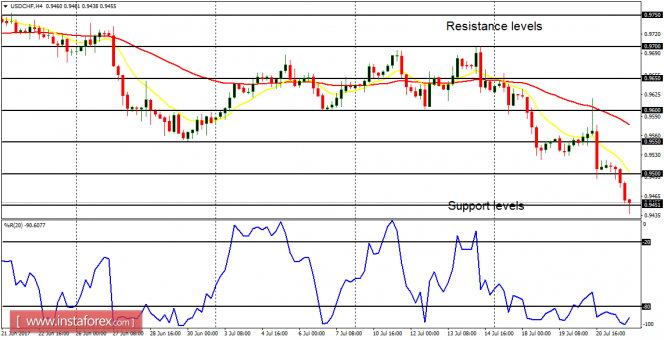

USD/CHF: The USD/CHF went south by 180 pips last week, having lost about 620 pips since May 11. There is a huge Bearish Confirmation Pattern in the chart and further downwards movement could be seen, as price goes towards the support levels at 0.9400, 0.9350 and 0.9300. On the hand, there could be a meaningful rally when USD gains stamina.

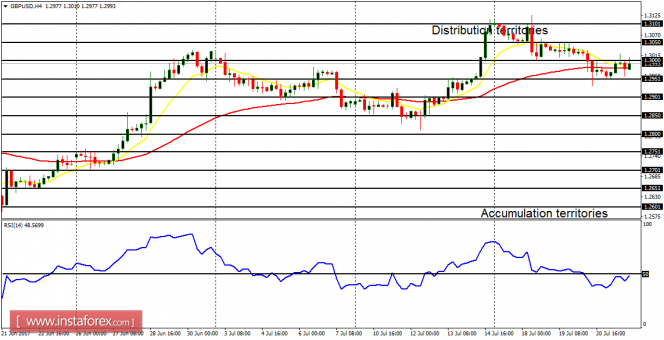

GBP/USD: The Cable is neutral in the short-term, and bullish in the long-term. A movement above the distribution territory at 1.3150 would strengthen the recent bullish bias; a movement below the accumulation territory at 1.2800 would result in a bearish bias. A movement between the distribution territory at 1.3050 and the accumulation territory at 1.2950 would result in further neutrality.

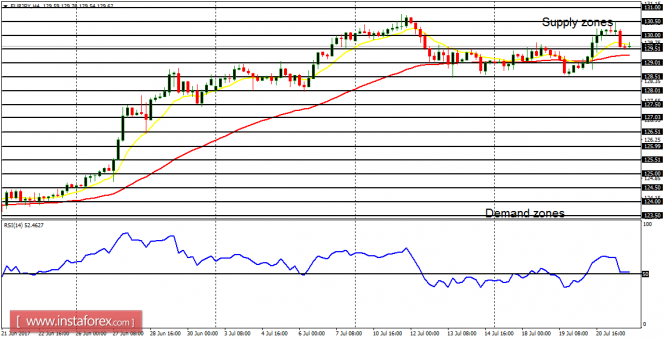

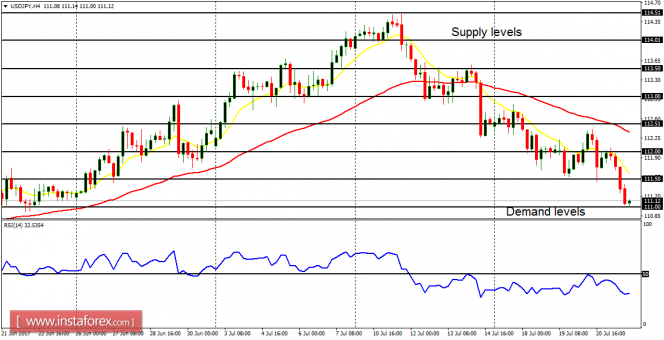

USD/JPY: The USD/JPY lost about 140 pips last week, testing the demand level at 111.00. Since July 11, the price has lost about 310 pips, leading to a Bearish Confirmation Pattern in the market. The demand levels at 111.00, 110.50 and 109.50 should be tested this week, owing to a strong bearish outlook on JPY pairs this week.

EUR/JPY: This cross has held out its bullishness so far. The market consolidated last week, and it can go further upwards from here, reaching the supply zones at 130.50 and 131.00. One reason the cross is able to remain bullish till now is the strength in the EUR itself, and things would begin to drop once the EUR loses strength. There is a possibility of a bearish reversal before the end of the month.