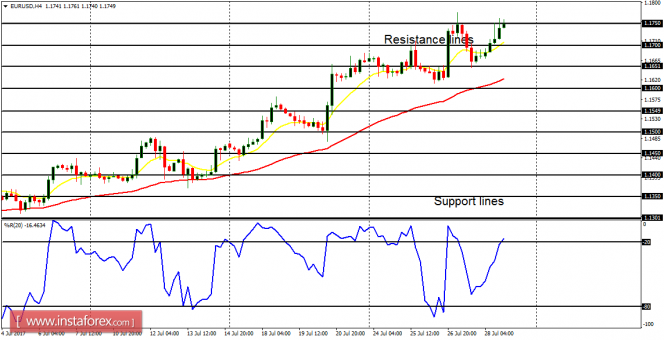

EUR/USD: The EUR/USD has generally been bullish this year, and the bullishness was continued last week. Price went north by 100 pips, testing the resistance line at 1.1750. There are additional resistance levels at 1.1800 and 1.1850, which could be tested before a considerable correction occurs. The outlook on EUR pairs is bearish for this week, but bullish for August.

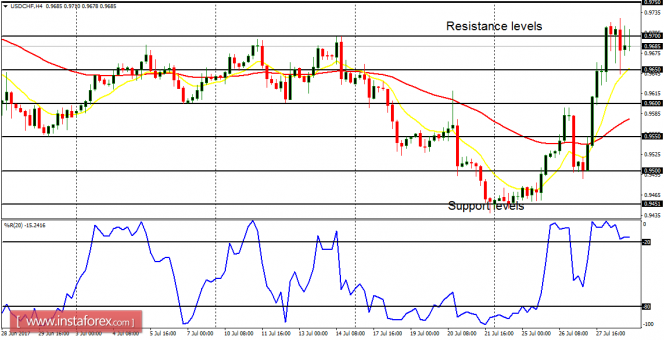

USD/CHF: Both the USD/CHF and the EUR/USD are now bullish – a rare occurrence. Both of them are normally negatively correlated, but the bullishness in the USD/CHF was brought about by an exponential weakness in CHF, which is expected to be reversed this week, for CHF would regain its losses. Thus, it is expected that CHF pairs would be strong this week and in August (while the CHF/JPY goes south).

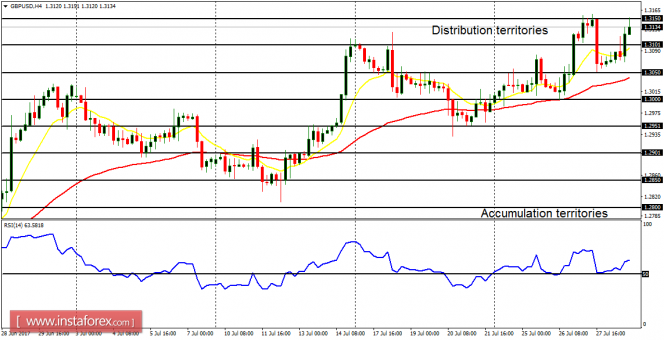

GBP/USD: The GBP/USD managed to go upwards last week, in what can be called a positive correlation with the EUR/USD. Price tested the distribution territory at 1.3150 repeatedly and it could breach it to the upside this week. Then another distribution territories at 1.3200 and 1.3250 would be aimed. In August 2017, there would be mixed results on GBP pairs.

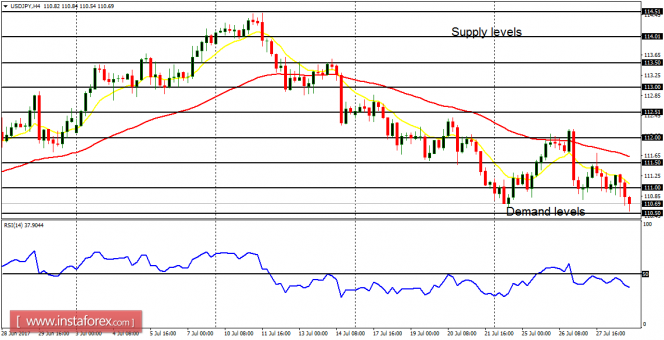

USD/JPY: In spite of bulls' attempt to push this market upwards, the movement last week was generally bearish. The demand level at 110.50 is now being targeted (after price closed below the supply level at 111.00 on Friday). Once the demand level is breached, another demand level at 110.00 and 109.50 would be targeted. The outlook on JPY pairs for this week and for August is bearish.

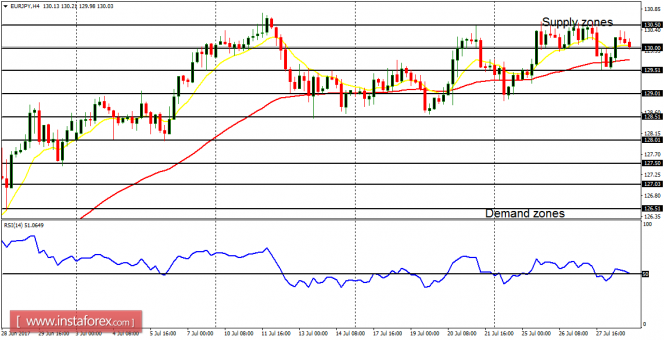

EUR/JPY: The EUR/JPY has been consolidating for about two weeks, thus causing a short-term neutral bias on the market. This week, price would either move above the supply zone at 130.50, to help emphasize a bullish outlook, or it would go below the demand zone at 128.00 to help emphasize a bearish outlook. One of the two possibilities would materialize within the next several trading days.