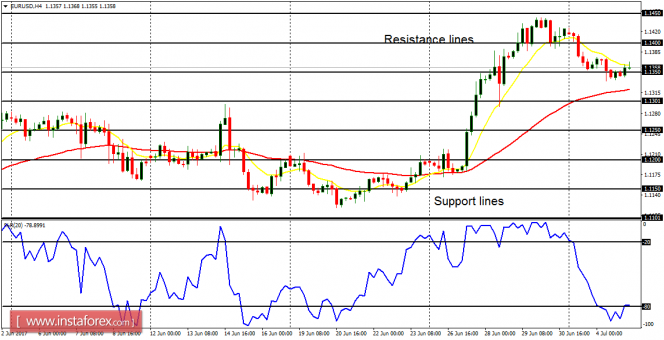

EUR/USD: The EUR/USD has been corrected lower and lower so far this week, but the correction is not yet strong enough to invalidate the extant bullish bias on the market. There is a need for price to go below the support line at 1.1250 before there could be a bearish signal, and that would require a serious selling pressure.

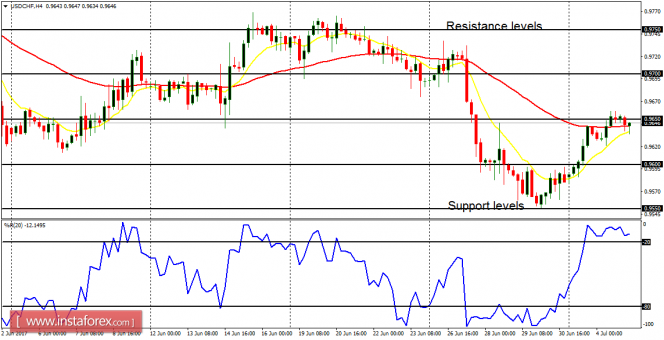

USD/CHF: On Monday and Tuesday, the price went upwards by 70 pips, testing the resistance level at 0.9650. The resistance level may be breached to the upside as price goes towards other resistance levels at 0.9700 and 0.9750. A movement above the resistance level at 0.9750 would result in a bullish bias.

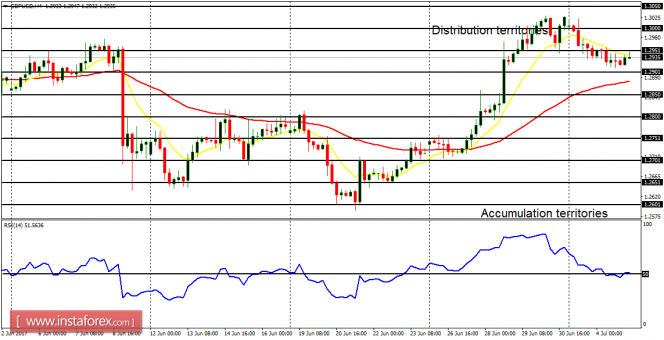

GBP/USD: The perpetual bearish correction that was seen in this market has posed a threat to the recent bullishness on it. The EMA 11 remains above the EMA 56, but the RSI period 14 has gone below the level 50. There are mixed signals in the market and one would need to wait for a directional movement. A movement to the upside would restore a Bullish Confirmation Pattern in the 4-hour chart.

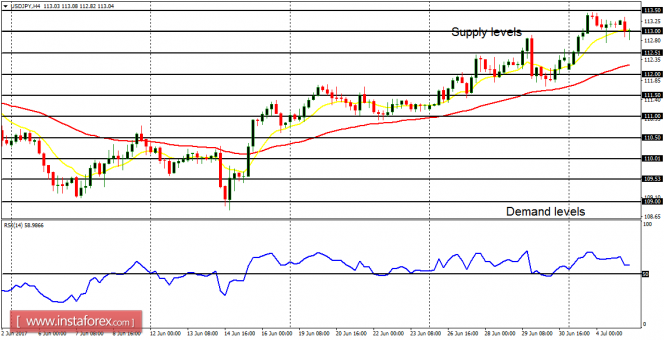

USD/JPY: The USD/JPY simply went flat yesterday, but a breakout may bring about further upwards movement, which may not hold out protractedly. There is a Bullish Confirmation Pattern in the 4-hour chart, and further bullish movement is a possibility (although the outlook on JPY pairs is bearish for this month).

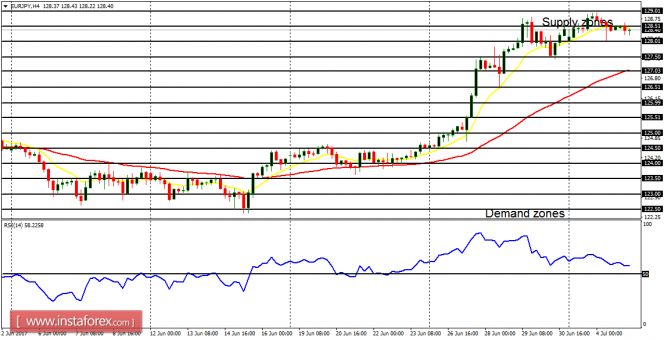

EUR/JPY: The EUR/JPY cross has moved sideways so far this week – in the context of an uptrend. There could be a breakout above the supply zone at 129.00, emphasizing the recent bullish signal, or there could be a breakout below the demand zone at 127.00, threatening the bullish signal.