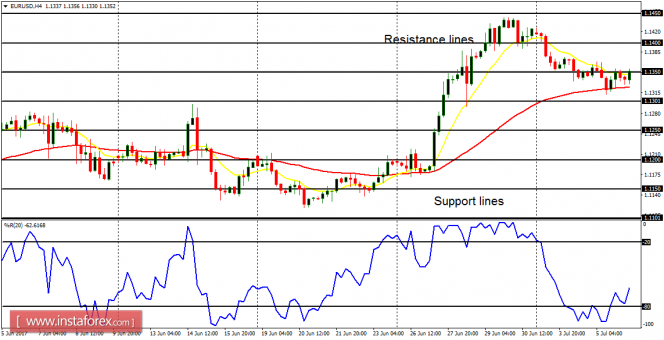

EUR/USD: This pair is trying to go upwards to confirm its recent bullish bias. A movement above the resistance lines at 1.1400 would help re-affirm the bullish bias, while a movement above the resistance level at 1.1450 would result in a Bullish Confirmation Pattern in the 4-hour chart. However, that would require strong buying pressures.

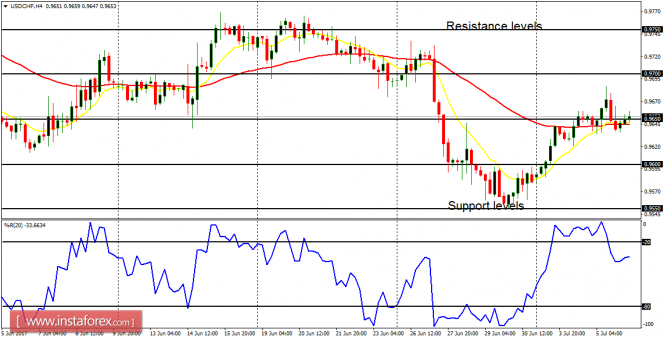

USD/CHF:

The USD/CHF pair is around the resistance level at 0.9650, trying to breach it to the upside. Price may even target another resistance level at 0.9700 this week, forming a bullish bias. Any further weakness in EUR/USD would help USD/CHF go further upwards. Some fundamental reports from the US are expected today and they may have an impact on the markets.

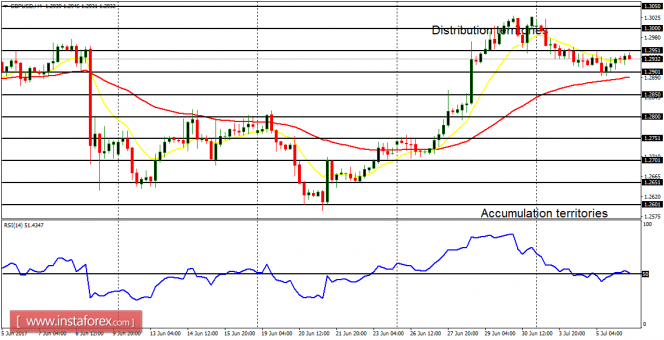

GBP/USD: There is now a short-term "buy" signal on the Cable. The EMA 11 remains above the EMA 56, and the RSI period 14 has gone above the level 50. Price is above the accumulation territory at 1.2900, and very close to the distribution territory at 1.2950. A movement to the upside would restore a Bullish Confirmation Pattern in the 4-hour chart.

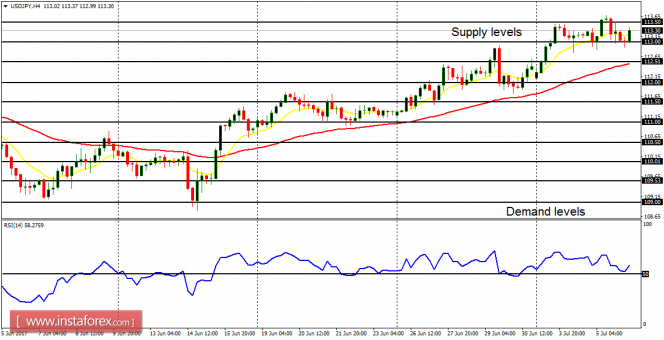

USD/JPY: The USD/JPY pair simply went flat yesterday, but a breakout may bring about further upwards movement, which may not hold out protractedly. Right now, the supply level at 113.50 is under siege, and it may be breached to the upside. This is a possibility, before things turn bearish.

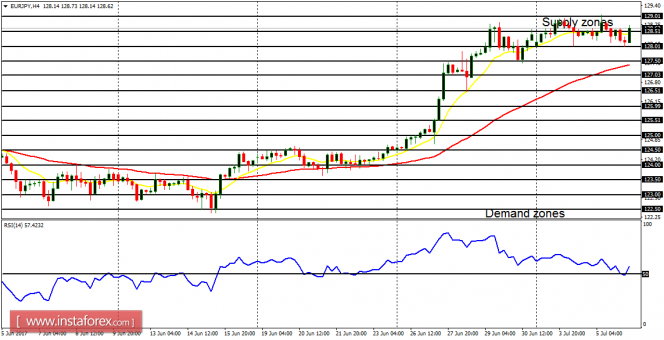

EUR/JPY: This currency trading instrument is also making some near-term bullish effort; though price has simply gone sideways so fat this week. It is above the demand zone at 128.50, and close to the supply zone at 129.00. Further northward effort may be witnessed before there is a meaningful bearish movement.