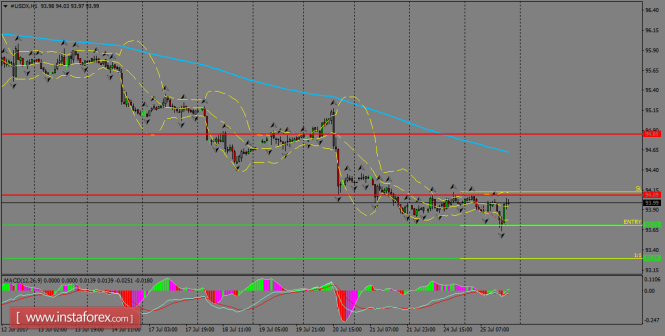

The index is still alive in the bearish trend and remains consolidated below the 200 SMA at H1 chart. However, the current tone is still sideways and as long as the greenback remains above the support level of 93.71, it can be looking for the 200 SMA to correct the downside in a first degree, around 94.60. MACD indicator is entering the positive territory, favoring that scenario.

H1 chart's resistance levels: 94.09 / 94.88

H1 chart's support levels: 93.71 / 93.29

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 93.71, take profit is at 93.29 and stop loss is at 94.12.

The material has been provided by InstaForex Company - www.instaforex.com