Global macro overview for 04/07/2017:

The Reserve Bank of Australia decided to leave the interest rates unchanged at the level of 1.5%, where it has stood since August 2016. In the Rate Statement, the RBA said, that inflation has declined recently due to lower oil prices and consumer inflation had moved higher over the past year. The RBA also said that the slowdown in first-quarter growth was temporary.

Contrary to the market's deceleration of decisive tightening, the monetary authorities have kept a cautious approach (inflation will gradually increase, wage growth will remain low) while simultaneously hitting currency strength. Nevertheless, Australia's economy was among the most vulnerable to rate increases given the nation's surging household debt and rising home values. Even a 1 point increase in the official cash rate would have negative consequences on the economy, and that's assuming annual growth of 3% with inflation at 2.5% ( home prices alone could slide 13%). This is why the next interest rate hikes are not very probable this year and with the current RBA inflation expectations, only a few interest rate hikes can be expected in 2018.

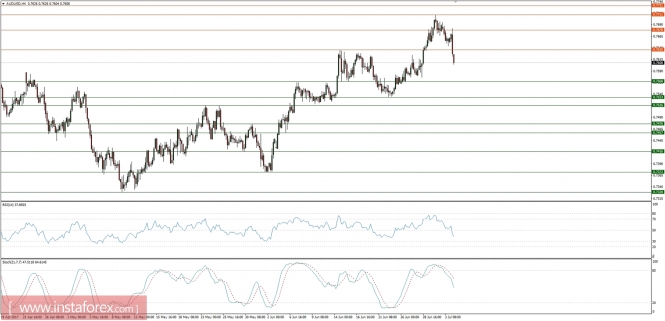

Let's now take a look at the AUD/USD technical picture at the H4 timeframe. The pair declined around 50 pips after the RBA decision, but it is worth to notice AUD/.USD climbed to fresh three-month highs last week. the market conditions are overbought and the next technical support is seen at the level of 0.7568 and 0.7533.